Last updated on August 7th, 2023

As an insurance agent, one of your best investments is a CRM system. This guide will outline how CRM streamlines your selling when offering plans.

If you’re an insurance agent and want to sell more plans, investing in customer relationship management software is best.

Why?

It accelerates your workflows, helps keep track of your leads, and boosts your sales.

(Plus, a host of other benefits.)

Keep reading to learn why you need a CRM that can be tailored for insurance agents and strategies to sell better using it.

Table of Contents

- What Is A CRM For Insurance Agents, And What Can It Offer?

- 5 Challenges That CRM Helps Fix for Insurance Agents

- 5 CRM Use-cases Insurance Agents Can Leverage To Sell Better

- The Top 5 CRMs For Insurance Agents

- CRM Roadmap: Steps Insurance Agents Can Do To Find The Right CRM

- Final Wrap-Up Of CRM For Insurance Agents

VipeCloud is the only Automation tool your small business needs to

be the hero to your customers.

With Email, Texting, Social, Suites, Chat, Stories, Video Email & Sign Up Forms fully built-in, we provide you with the perfect platform to grow your business.

15 Day Free Trial – Get started risk free. No CC needed.

What Is A CRM For Insurance Agents, And What Can It Offer?

A CRM is software that helps you manage your relationships with prospects and your various customers.

As a central operations hub, it even offers sales tools to convert sales-qualified leads and automation to make follow-up easier.

It’s valuable for insurance agents since it simplifies lead and deal tracking.

Think about it:

How often do you forget to make touchpoints with specific prospects due to your busy schedule? (It happens…)

CRM helps ensure prospects are not forgotten, especially in long buying cycles.

A better system for navigating your deals makes selling insurance plans more predictable.

Bear in mind that having a large pool of leads is another success factor.

The more conversations you have at any given moment, the more they trickle down your sales funnel and the higher your probability of closing.

For that reason, all-in-one CRMs like VipeCloud offer marketing capabilities to increase leads at the top of your funnel:

- Email automation

- Text message blasts

- Social sharing

There are various marketing channels to fill your calendar.

From there, here are the 4 tenants that affect your closing rate:

1. Your sales methodology (for qualifying, overcoming objections, and closing)

2. Insurance plan fit/benefits

3. Follow-up cadence and strategy

4. Lead management and staying organized (with CRM)

5 Challenges That CRM Helps Fix for Insurance Agents

1. Consistently Driving New Leads

Without enough leads, the odds of closing on a deal diminish since meeting volume isn’t on your side.

You can be ahead of most insurance agents by fixing your lead generation woes.

How CRM Fixes It

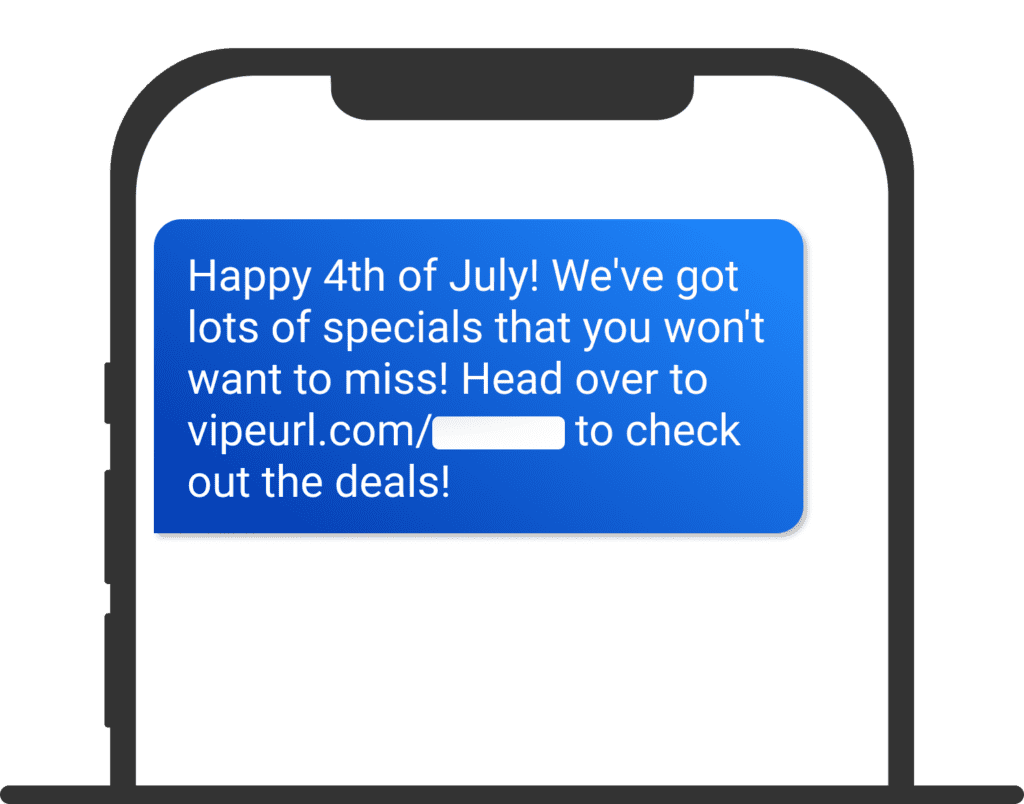

As mentioned earlier, CRM can provide email, text, and social sharing functionality.

But generating leads is more than just choosing the right channel.

Your offer should be compelling, speaking to your customer’s needs (referencing company data/information you have on your ideal customer or market research can help with this).

Once you have the right messaging, you can split test your campaigns to find what people are resonating with. You can test:

- Email subject lines

- Calls to action

- Relevant customer stories

- Lead capture page vs. a multi-page funnel

2. Inefficient Workflows

Things like manual entry for your admin tasks have an efficiency cap.

Think about it, just having to manually remind customers of policy renewals is something that can be simply automated.

Workflow automation saves you time — let’s see how it can be done using CRM.

How CRM Fixes It

CRM email automation lets you automatically send emails to specific contacts on specific dates.

So whether you’re reminding new prospects of a calendar call or informing current customers about their plan, email automation is vital.

Text message campaigns may work even better since the average open rate of a text message is 99%, with 97% of messages being read within 15 minutes of delivery.

3. Consistent, High-quality Customer Service

Selling doesn’t end once someone is a customer.

Sure, your sales process is what ignites the customer relationship and gives your clients their first impression of you and your company.

But many insurance agents forget to continually sell that the customer made the right choice by signing on the dotted line. To prove that they’ve made the right choice, providing excellent customer service is how it’s done.

This means getting back to your clients promptly, guiding them with any insurance upgrades or downgrades, and educating them on their plans.

How CRM Fixes It

CRM provides customer service pipelines that you can customize to reflect different customer categories.

For instance, you can have each column dedicated to the different insurance plans you provide.

Even further, you can set tasks to send certain documents on crucial days related to those plans.

Pipelines also offer notes where you can jot down information about each customer for future reference.

And don’t forget your contact records, where you can store up-to-date contact info on your customers to reach them with speed.

Pro-tip: Not sure if a long-term client’s email is still working? Use VipeClouds’s email verification tool to check the health of an email address.

4. Unorganized Sales Process

Without a structured sales process, it can be like pulling teeth to know which prospect is where in the buying process accurately.

Even further, how do you quantify if someone is sales-ready?

Agents struggling to organize their selling may lose out on more deals than they’re comfortable with

How CRM Fixes It

CRM lets you not only create sales pipelines but score your prospects to find those who are most buyer ready.

In other words, lead scoring can be used to add or deduct points when:

- A prospect’s attributes (age, job title, yearly income) do or don’t match your ideal customer profile (ICP)

- A prospect’s behavior does or doesn’t match buying cues (scheduling a call with you, replying to your follow-up emails, etc.).

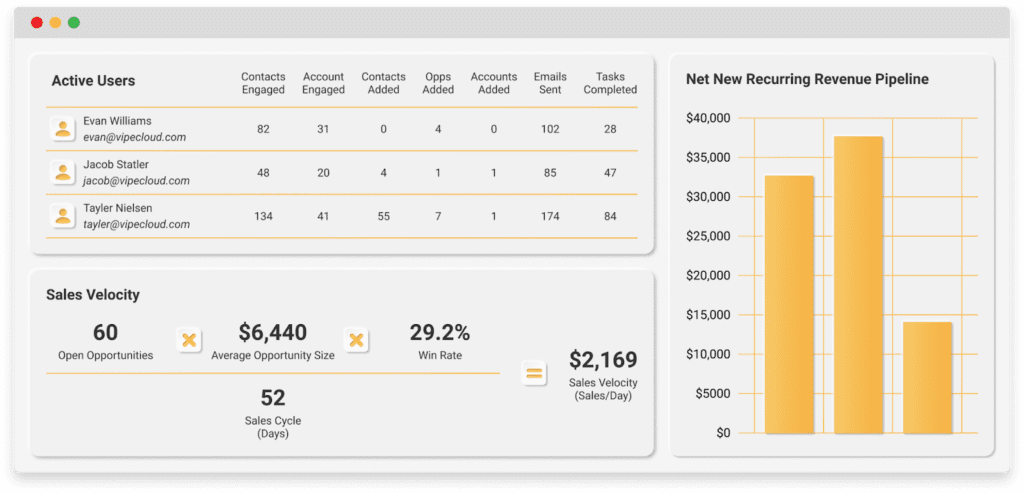

Lastly, there are CRM sales reports, which show the state of your sales. You’ll find metrics like:

- Your win rate

- Sales velocity

- Recurring revenue

- Number of opportunities

5. Lack of Re-marketing And Follow-up

A lack of follow-up and remarketing makes it more difficult to warm up cold prospects.

The truth is 1-2 touchpoints just doesn’t cut it in today’s world.

Prospects lead their own lives, so as an insurance agent, consider having a way of being omnipresent for a given timeframe.

Let’s look at how CRM can make following up more lucrative and less time-consuming.

How CRM Fixes It

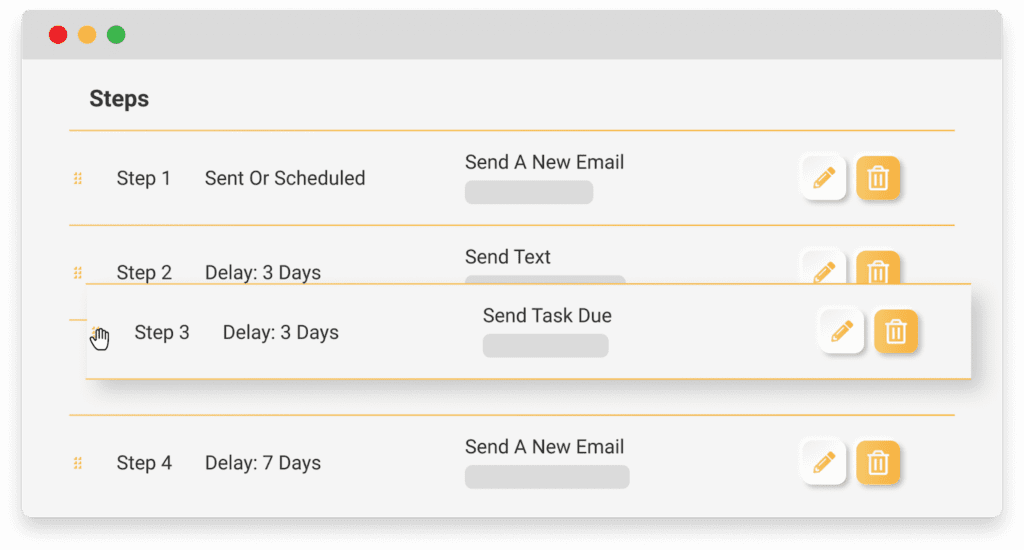

With CRM, you can create drip campaigns to nurture a list of customers through time.

And this can be a mixture of different marketing channels. Here’s a good example:

IRC Sales Solutions reported that only 2% of sales happen during the first point of contact

And only 8% of sales professionals follow up 6 or more times.

Drip campaigns allow you to follow up at an optimal frequency in a timeframe that isn’t too pushy while keeping things automated on your end.

5 CRM Use-Cases Insurance Agents Can Leverage To Sell Better

Here are 5 CRM tools that help improve how you sell insurance plans in the future.

1. Drip Sequence After Form Submission

As mentioned, this CRM use-case ensures you make contact as fast as possible, which is especially important after form submission.

Why?

You’re more likely to get a hold of prospects when they’re contacted within 5-10 minutes after form submission.

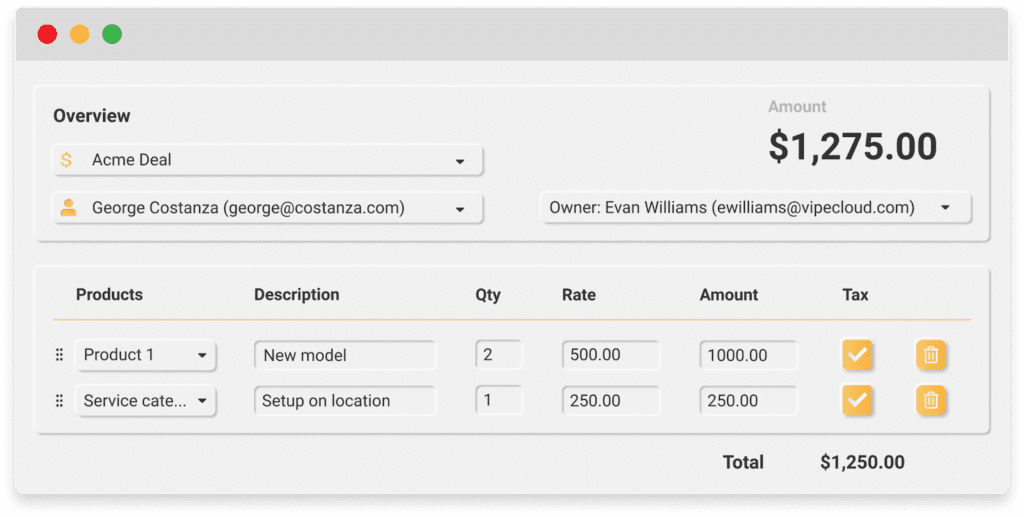

2. Sending Plan Estimates Using CPQ

CPQ allows you to send pricing quotes with speed.

You can set your various insurance plans and price add-ons to send a customized plan to each customer when they’re ready.

With VipeCloud Estimates, you can track whether or not they’ve accepted your quote via email.

From a big-picture standpoint, this helps the customer experience since customers can quickly compare your rates with any other insurance provider they use.

3. Sales Forecasting Using Reports

Sales forecasting helps you anticipate month-to-month revenue from your deals.

This can be done based on the value of your sales pipeline.

You can also forecast using a customer pipeline and base your numbers on policy renewal commissions.

Organizing your sales process puts you ahead of most insurance agents regarding performance and productivity.

4. Email Video And Stories For Following Up

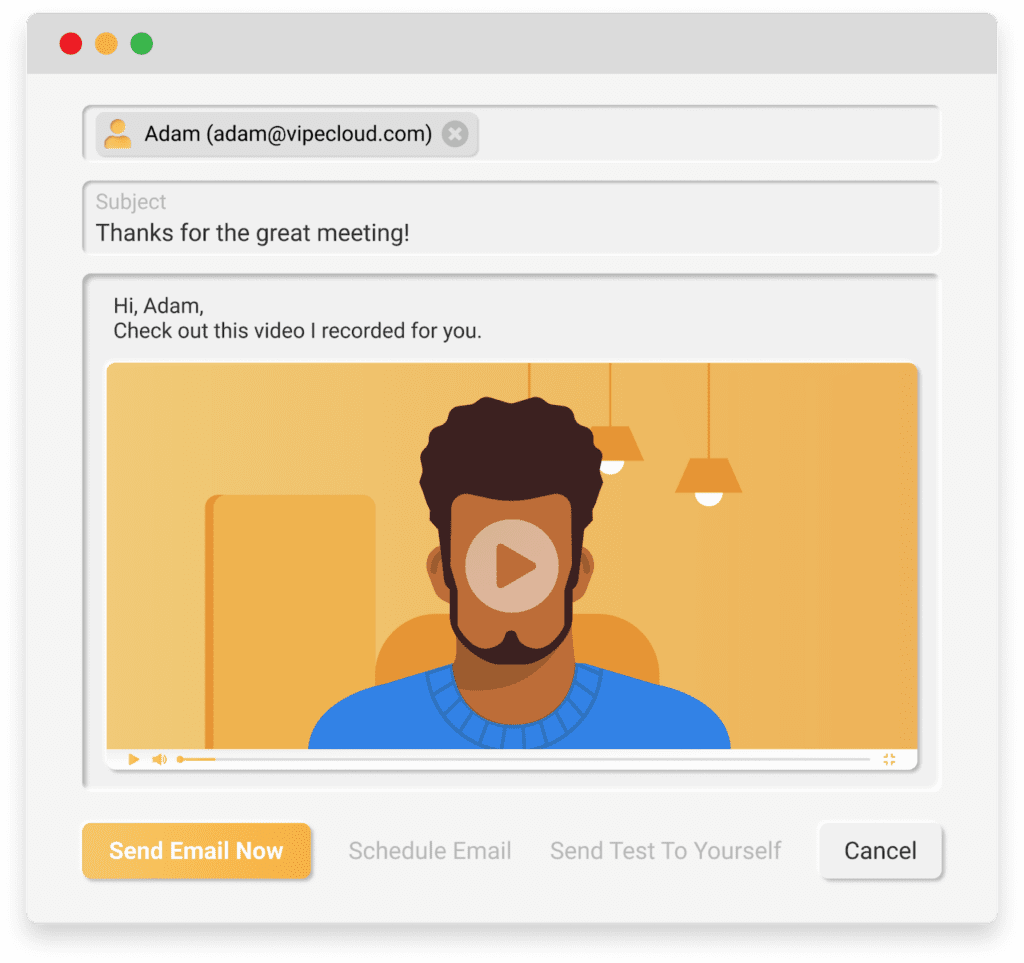

Everyone knows email and text message follow-up, but with VipeCloud, you can take things a step further with video email and stories.

Video email lets you send short clips to your recipients, which can showcase a more innovative form of follow-up (consider personalizing your videos for best results.)

Email stories take the shape of social media stories in email format. This tool lets you piece together photos and videos in a digestible way to sell your plans.

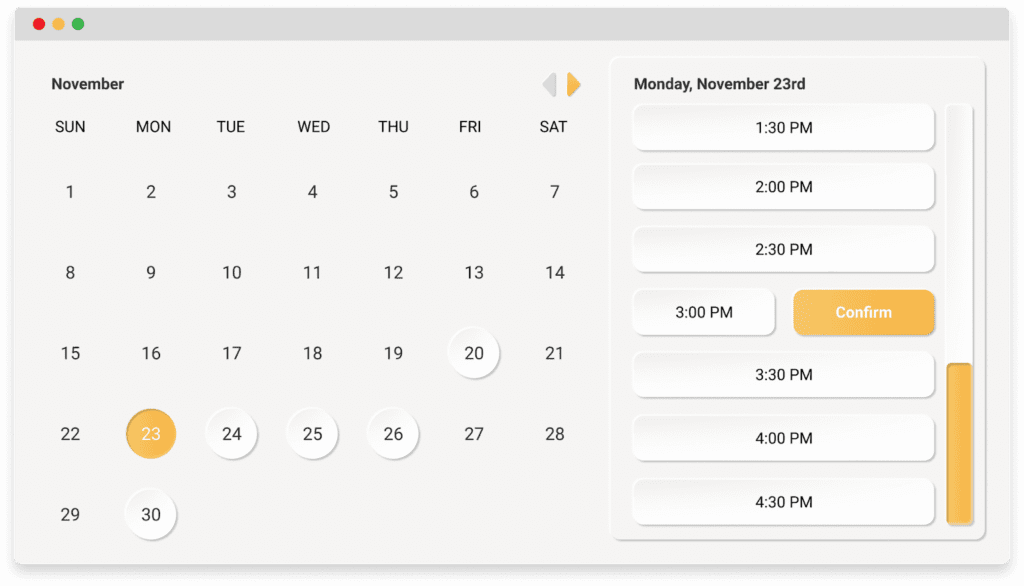

5. Bookings Calendar For On-Time Meetings

CRM schedulers ensure that meetings take place structurally.

As an insurance agent, 1 missed call from a prospect can mean the difference between hearing or never hearing from them again.

For that reason, creating a calendar that notifies you about your attendees is crucial.

Your calendar also helps communicate information about your contact to your record by automatically syncing their meeting information.

The Top 5 CRMs For Insurance Agents

1. VipeCloud

Vipecloud is a CRM that helps the small and medium-sized business sector improve customer relationships.

As a flexible solution, it can be tailored easily for insurance agents to help them market and sell year-round.

Why VipeCloud Is The #1 CRM For Insurance Agents

VipeCloud includes essential tools for insurance agents to take advantage of. Here are just some of them:

- Pipelines

- Estimates

- Automation

- Schedulers

(Soon, we’ll go over each feature and its benefit.)

VipeCloud offers high ROI for those in “solopreneur” roles, and this likely hits close to home as an insurance agent.

The tools available make it easier to market and sell while saving precious time on admin tasks. It’s like an assistant at a fraction of the price.

VipeCloud Support

- CRM Demos (personalized walk-throughs)

- Stellar customer service

- CRM implementation ideas based on industry

- VipeCloud’s CRM success blog

- A YouTube channel with helpful videos

- CRM migration

VipeCloud Features & Benefits

- Forms – Capture lead data quickly and sync that information into your records streamlined.

- Estimates – Speed up how quickly customers get your pricing quotes and track how they interact with them.

- Email, SMS, social sharing – Market in multiple platforms and centralize your marketing data all into VipeCloud.

- Service and sales Pipelines – Create multiple pipelines for your sales cycle and for your service delivery. Service providers can better manage their day-to-day operations this way.

- Contact Scoring – Rank your most valuable prospects and know the ones who fit your ideal customer profile (ICP) the best based on their behaviors and attributes.

- Task management – Know exactly what needs to be done, by who, and when with tasks. This augments productivity which compounds well in just a given quarter.

- Scheduler – Let prospects and clients set a time to meet with you and block off times when you’re unavailable. Meeting reminders get sent to ensure everyone shows up for important meetings.

- Segmentation – Segment contacts based on commonalities so that your marketing messages resonate with the right audience. This boosts the likelihood of successful text and email campaigns.

- Integrations – Let VipeCloud communicate with your most used software so that information moves from system to system without too much manual work.

- Reports – Get precise and up-to-date information on the state of your sales and marketing efforts and team activity. Reports help eliminate sales ambiguity which is what many SMBs struggle with.

VipeCloud Pricing

VipeCloud offers 4 affordable pricing tiers based on your needs. The best part is that all tiers are month to month, meaning no extended contracts.

Here’s how the pricing measures up when billed annually:

- Plus – $20 (or $25 monthly)

- Pro – $40 (or $50 per user monthly)

- Enterprise $60 (or $75 per user monthly)

- Custom solution – Contact us.

Here’s what each tier consists of:

Plus:

- Feature-rich CRM, one pipeline

- 2K contacts

- 10K monthly emails

- Email marketing

- Video email

- Texting

- Stories

- Social sharing

- Sign up forms

- 1 user

Pro:

- Everything in Plus, along with:

- 10K contacts per user

- 30K monthly emails per user

- Sales & marketing automation

- Custom fields

- Account management

- Sales estimates & QuickBooks integration

- Inbox sync

- 1 scheduler

- 1 team

- Phone support

- Up to 10 users

Enterprise:

- Everything in Pro, along with:

- 60K contact per user

- 60K monthly emails per user

- One-email-per-minute mass email processing

- Multiple schedulers

- Website tracker

- Contact scoring

- 10K email verifications per month

- Multiple pipelines

- Multiple teams

- Unlimited users

Custom:

- Everything in Enterprise, along with:

- Custom contact count

- Custom email sending quantity

- Custom email verifications quantity

- Dedicated SMTP delivery account

- Dedicated IP addresses and rDNS support

- Custom implementation and training

4 Other CRMs For Insurance Agents

- Pipedrive – Pipedrive focuses on sales-based use cases. You can add a marketing CRM option for lead generation needs.

- SugarCRM – Offers marketing, sales, and customer service functionality with vendor support present.

- Insightly CRM – Offers accurate reporting on the state of your insurance marketing and sales.

- FreshSales – An all-in-one CRM solution also offering call functionality

CRM Roadmap: Steps Insurance Agents Can Do To Find The Right CRM

Here’s a quick roadmap to make the CRM selection process simple for you

1. Having a CRM evaluation checklist – Helps find your CRM needs and ideal pricing

2. Getting an adequate CRM sample size – Evaluating 3-5 CRM solutions

3. Compare and narrow down – Find the best CRM based on your criteria

4. Choose a solution

Final Wrap-Up Of CRM For Insurance Agents

The goal of using a CRM is to increase the likelihood of selling more insurance plans.

This will require getting adequate lead volume and an organized sales process where you speak to enough prospects with the proper sales methodology to close them.

The best CRM to start with is VipeCloud’s Sales and Marketing suite, thanks to its robust functionality for insurance agents.

Want to see even more practical ways you can use VipeCloud? Request a demo, and we’ll walk you through the CRM.

If you’re ready to start, you can access a free 15-day trial of VipeCloud today.

Leave a Reply