Last updated on March 21st, 2025

Today you’ll gain helpful ideas on how to market your private mortgage company effectively and gain qualified borrowers.

Marketing takes companies from zero to hero in today’s world when it follows a proven plan of action.

When it comes to the mortgage industry, borrowers have more access to more lenders now than in history.

So if you own mortgage brokerage or are a key decision-maker in a mortgage company, it’s paramount to implement marketing strategies that help you stand out!

And when coupled with a CRM (which we’ll talk more about later), you’re on your way to working with the ideal clients you’ve envisioned.

Here’s what you’ll learn:

- What Is Mortgage Marketing & Why Should I Focus On It?

- How Do I Create A Mortgage Marketing Plan?

- How Do I Market My Mortgage Company? (Proven Online & Offline Strategies)

- How Do I Determine Good Leads From Bad Leads?

- How Do I Nurture Mortgage Marketing Leads?

- What Is The Best CRM Software For My Mortgage Company?

VipeCloud is the only Automation tool your small business needs to

be the hero to your customers.

With Email, Texting, Social, Suites, Chat, Stories, Video Email & Sign Up Forms fully built-in, we provide you with the perfect platform to grow your business.

15 Day Free Trial – Get started risk free. No CC needed.

What Is Mortgage Marketing & Why Should I Focus On It?

Mortgage marketing is how a mortgage company or lender markets their lending services to an audience to convert them into clients.

Like many other industries, the goal is to bring your leads down your marketing funnel in a smooth and not too lengthy way.

Institutional mortgage lenders (credit unions, banks, etc.) and private lenders (mortgage lending companies) market differently due to what guidelines they have to follow.

Private companies can market with more leeway since they have fewer government regulations than institutions.

Whether you lend directly or connect borrowers to lenders, focusing on your marketing is essential because it’s one of the main activities that moves the needle in your business!

This starts by creating a solid plan and implementing it to find your ideal clients.

Because without one?

You’re less likely to see marketing success and understand how to fix conversion leaks.

How Do I Create A Mortgage Marketing Plan?

1. Get Clear On Your Goals

Your marketing goals are a great place to start — when you begin mortgage marketing or are changing your marketing strategy, you want to get clear on what you want.

The best way to break this down is in terms of KPIs and timeline. These are essentially the marketing metrics you want to influence in a particular time frame.

This can be things like your website page conversion rate, number of applicants, number of borrowers (clients), website/landing page visitors, email list subscribers, and so on.

Also:

It’s ideal to focus on one KPI for whatever marketing method you’re using.

So, for example, if you’re running Facebook ads to get more email subscribers, website visits are nice, but the most critical metric is email list subscriptions.

Here are examples of marketing KPIs & timeline ideas for your marketing plan:

- Increase website traffic by 25% by XYZ date.

- Receive x% more lending applications by x months.

- Get x more clients in the next 90 days.

- Shorten mortgage closing cycle by x number of days, by XYZ date.

2. Target audience

Next, you should jot down your ideal customer profile (age, marital status, geography).

You can take the commonalities of your current customers to help you pinpoint who you want to target.

Maybe you typically work with 24-35-year-old newly-weds that want loans for houses in the suburbs…

Or new young homebuyers in a particular geographical area.

The customer profile is important because it allows you to tailor your message to the people you want to work with.

They, in turn, will feel as though you’re the perfect fit for them because you know their desires when it comes to getting their dream home.

Whether it’s B2C or B2B, 80% of customers have a higher likelihood of purchasing a service when a company provides a personalized experience.

3. Marketing budget

Your marketing budget is crucial — and depending on the marketing avenue you choose, your budget can vary.

If you’re doing paid digital ads, you want to prepare a bigger monthly budget compared to investing in something like SEO services, for example.

Both organic and paid marketing have their strengths (which you’ll see very soon).

If you have an internal marketing team, work with them to create a budget that works for your mortgage company while still being effective on the ad platform you choose.

You can also always hire a marketing agency which typically costs less than an internal team as far as services go.

4. Scope of Work (SOW)

Whether you’re working with an internal team, agency, or doing it yourself, you want to create a scope of work piece that fully outlines your marketing plan, expectations, and some variables that may come up.

This doesn’t have to be overly complicated, just a tangible document you can revisit now and again to keep your KPIs in mind.

Ok, now let’s dive into the online and offline ways of marketing your mortgage company!

How Do I Market My Mortgage Company? (Proven Online & Offline Strategies)

Online Marketing

Local SEO

SEO stands for search engine optimization. This is when you use keywords with adequate search volume in your area on your website.

This includes any blogs, pages, or other sections of your website.

Local SEO is also how you show up in business directories and how consistent your location and contact information is across the web!

The end game is for search engines to rank you higher, which helps you gain more site visitors.

SEO is a great long-term strategy for seeing more monthly visitors that are looking for mortgage lenders. Since search engines show results based on geographical area, leads in your area are very likely to see your business.

However, keep this in mind:

It’s ideal to give your SEO strategy 3-6 months to really see results.

Hiring an SEO agency/professional would be an excellent place to start if you aren’t too familiar with it or don’t have the internal marketing staff.

The higher you rank, the better because it’s reported that 92% of people that search pick businesses on the first page!

Google & Facebook Ads

Google and Facebook ads are often mentioned together when it comes to paid marketing, but they have their fundamental differences.

With Facebook, you can create a daily budget for tons of different campaigns (lead generation, brand awareness, website visits, and more.)

You can target specific types of customers, and the algorithm will show your ad to those people.

On the other hand, Google ads is known as PPC (Pay-per-click) marketing and are ideal for search-based services.

You advertise based on keywords and are only charged when someone clicks on your ad.

Google ads fit well for mortgage companies because people who are looking for mortgage loans usually hop right on Google to look for a good company.

If your mortgage company is well advertised with an attractive offer, you’ll get a good chunk of clicks and opt-ins.

If you’re using Facebook alongside Google ads, a good mortgage advertising idea would be to use Facebook ads as a retargeting tool.

This means everyone that has clicked and visited your website from a Google ad campaign will see your ad as they scroll through Facebook.

This is a great way of being seen again because, according to “The Rule of Seven” people need to see you at least 7 times before taking action.

But in today’s world, lots of things are pulling your audience’s attention, so it may be even more!

Email Marketing

Email Marketing has stood the test of time because everyone and their grandma checks their email.

Mortgage email marketing is your chance to share value, information about mortgage lending, and your customer testimonials. You can even talk about the housing market as a whole.

The goal here is to position yourself as an authority and nurture your leads (give touchpoints.) With emails, remember to have a CTA that tells your email subscriber how they can take action.

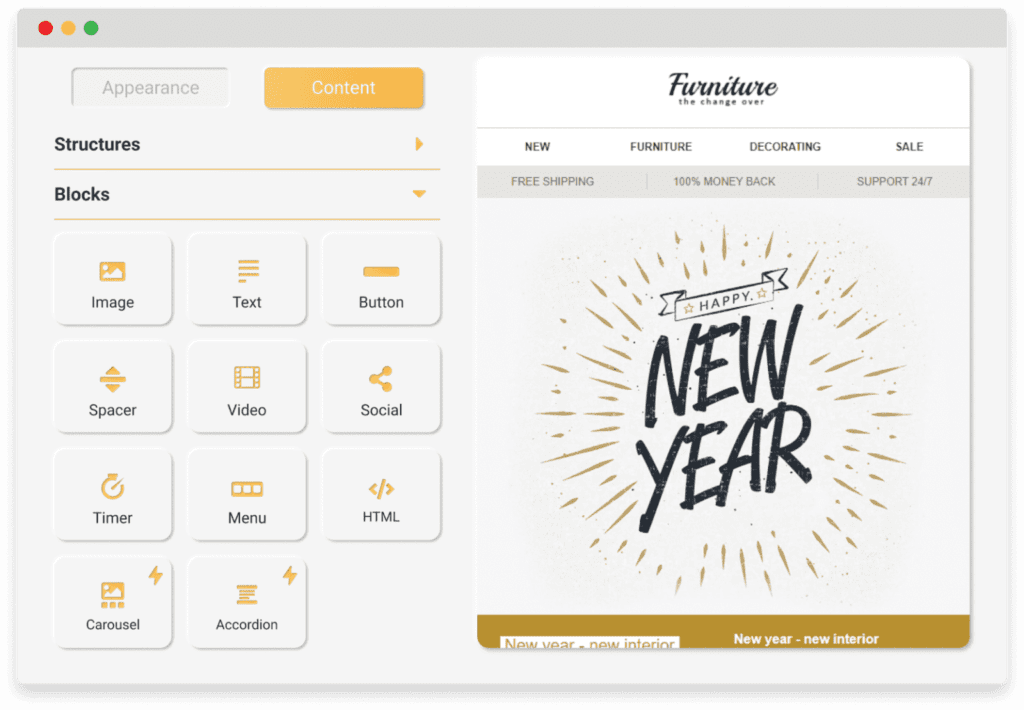

Vipecloud’s Newsletter feature is an excellent tool to take your email marketing to new heights quickly.

How?

You can choose from amazing templates and track how your readers engage with your emails (opens, link clicks, video views, and more.)

For more information, check out our article on email lead generation!

Social Media Content Marketing

“Social media is a contact sport” is a popular phrase in marketing because it’s very true.

Your ideal clients are on social media, and being in contact with him isn’t just about following them and them following you.

It’s about conversing with them — so if you have sales reps, they should be on these platforms engaging!

Facebook and LinkedIn are great places to start. Like email, you can give value to your audience and tell them a bit more about your services.

Social media content marketing also acts as great social proof when people find your profiles through googling your company.

Bringing Your Traffic To A Landing Page

With the different marketing strategies, I just mentioned, landing pages are crucial when it comes to where you send traffic.

Sure, you may have a website, but landing pages make it simpler for your leads to sign up because there are fewer distractions (buttons, links, etc).

A good landing page builder will also allow you to send nurturing emails for leads!

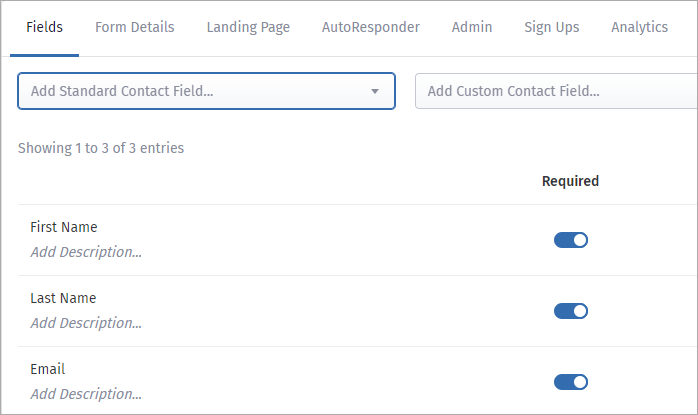

Vipecloud’s Sign-up Forms is a landing page builder that makes building an effective page very simple.

When sending traffic to a landing page, you should have clear CTAs for what you’re optimizing for as well as simplicity (avoiding tons of pop-ups and drawn-out phrasing.)

It’s also a good idea to have separate landing pages for distinct types of conversions.

So if you’re offering interest rate quotes, that should be a separate landing page from a loan qualification landing page.

Check out our article on landing pages for a deeper inside scoop on how that works!

Offline Marketing

Let’s dial the time back to when no one knew what “WiFi” even meant.

In the olden days (and still today), business owners used offline marketing as a great tool for gaining attention in their local area.

If you couple these with an adequate online marketing strategy, you’re putting yourself in a position to flourish.

Here are some offline marketing strategies you could implement for your mortgage company:

- Signage – Signs outside your office building, signs in intersections, and areas that are legal.

- Company Vehicle Wrap – Adding your mortgage lending company’s name and contact information to a company vehicle.

- Create a Referral System – Create an incentive for clients to refer you to people they know.

There’s one caveat you should keep in mind with offline marketing:

There has to be a way of tracking results!

One way of doing this is by asking customers how they found you on lending applications and keeping a record for each client in your CRM pipeline.

In this way, you can see which offline marketing strategy is getting you the best results.

How Do I Determine Good Leads From Bad Leads?

The leads you get from your marketing campaigns may vary.

You’ll generate amazing mortgage leads, some so-so ones and some “Did you click the wrong button?” ones.

To gauge good leads from poor mortgage leads, you should analyze the average borrowing qualification of the leads. This means, on average, how many of the leads were qualified to be clients of yours?

So say you get 100 leads, you can tally how many of them had adequate credit, good income qualifications, and other factors.

Quality over quantity is the name of the game.

Good leads typically are ready to move forward, fit your qualifications, know what they want, and provide paperwork in a timely manner.

Bad leads are usually flaky, have a low qualification, or don’t know their lending needs.

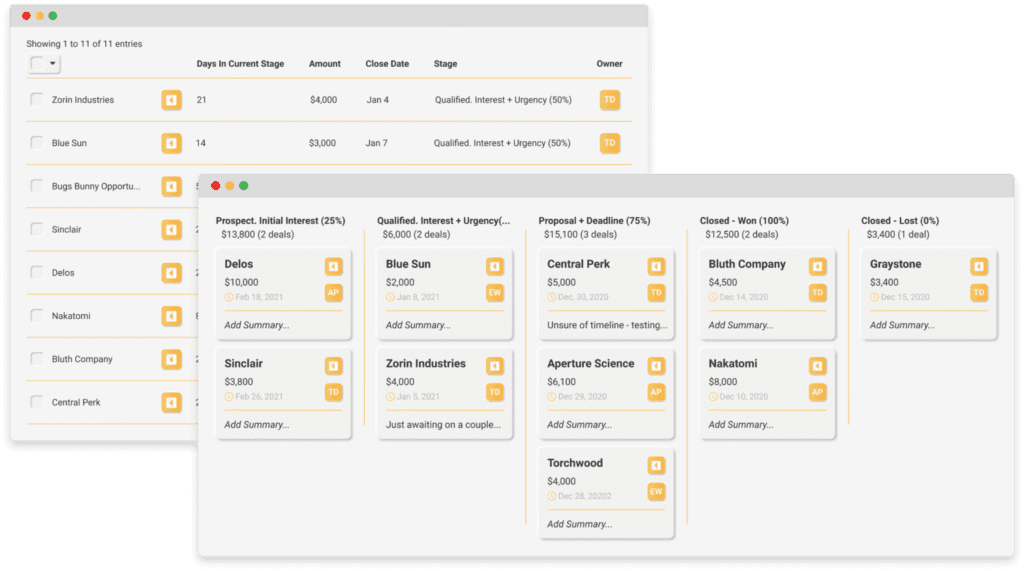

There’s an ultimate tool that makes this process super simple for you, and it’s called contact scoring.

This tool allows you to rank your leads from highest to lowest priority by giving them a number (score).

Why is this important?

It allows your team to have better sales productivity because you’re getting in contact with your sales-ready (most important) leads faster. These will be highly qualified leads that have interacted with your business and/or check all the boxes you’re looking for in a borrower (good credit score, solid debt-to-income ratio, consistent income statements, etc.)

How Do I Nurture Mortgage Marketing Leads?

In marketing, “nurturing” is how you create a connection with your leads and guide them through the buying journey.

The truth is when people are looking for mortgages — they’re looking at multiple mortgage companies and even government-back institutions to get the best mortgage possible (adequate mortgage rates, contract terms, etc.)

With this in mind, being at your customer’s forefront by using email, text, phone, social media, or other forms of marketing are essential ways to nurture them.

For example, you can get an idea of your typical sales cycle length and create a sequence of email and text message automation every now and again throughout the cycle.

And since mortgage lending is a very conversational industry, having your team set task reminders to call specific leads by phone is important too.

The absolute best way to do this is by using a sales CRM that lets you market and sell efficiently throughout the buyer journey.

Things like viewing what stage your lead is on your pipeline and the last time you made a touchpoint with them is how companies are closing sales-ready leads.

When you’re top of mind in a way that’s natural and not too salesy, you’ll find yourself converting more “long-term” prospects.

What Is The Best CRM Software For My Mortgage Company?

Mortgage marketing has a good chunk of moving parts to it.

From lead generation to close, having systems in place to nurture your leads is what will shorten your sales cycle and make your marketing (and sales) more effective.

And guess what?

Vipecloud has created a stand-alone CRM that bundles your most crucial marketing and sales tools into one place.

Vipecloud’s Sales & Marketing Suite is a highly customizable and versatile CRM that helps mortgage companies & brokerages level the marketing playing field with competitors and possibly some institutions.

You can create pipelines, leverage automation, build landing pages, and much more!

Try Vipecloud’s Marketing & Sales Suite for free today — no credit card required.

If you’d like a demo from our knowledgeable staff, you can request one here!

Great article! Mortgage marketing is crucial for success in the industry. The tips and strategies shared here are practical and insightful. I particularly liked the emphasis on personalization and building relationships. Keep up the good work! Thanks for sharing this article with us.