Last updated on August 7th, 2023

Looking to get started with a financial advisor CRM? This guide goes over tips to choose and use CRM software — and the best 5 CRMs for you to consider.

Financial advisors can do a lot with CRM, from serving clients and analyzing revenue — to tracking new leads.

Thanks to its plethora of features, an all-in-one financial services CRM acts as a helping aid for marketing, sales, and service delivery.

This guide gives you different ways to use a financial services CRM, plus the 5 best ones to consider and why.

Table of Contents:

- What Does CRM Do For Financial Advisors?

- What Features Should Be In A Financial Services CRM?

- 8 Ways To Use CRM For Wealth Management Services

- The Top 5 CRMs For The Financial Services Industry

- 3 Best Approaches For Choosing A CRM

- Scale Your Financial Services With VipeCloud

VipeCloud is the only Automation tool your small business needs to

be the hero to your customers.

With Email, Texting, Social, Suites, Chat, Stories, Video Email & Sign Up Forms fully built-in, we provide you with the perfect platform to grow your business.

15 Day Free Trial – Get started risk free. No CC needed.

What Does CRM Do For Financial Advisors?

With CRM (customer relationship management), financial advisors can better manage and track client information in one place.

In other words, a financial advisor CRM allows you to track all of your contacts, along with their data to provide a better customer experience.

CRM also has automation capabilities to save you time on your workflows (ex., following up, sending information, etc.).

This means you can reach your prospects quickly and deliver resources to current clients faster.

Financial advisors can use CRM to track business performance too.

In fact, 82% of organizations use CRM systems for sales reporting.

CRM reporting analytics give you a top-down view of the health of your business or company.

Which can help you make data-back decisions for your business (and clients).

As a financial advisor, you can boost your daily efficiency with a CRM.

Especially with the right features.

So let’s look into the CRM features for financial service professionals.

What Features Should Be In A Financial Services CRM?

Remember that a CRM’s value will depend on how well it meets your needs.

So it’s essential to get clear on your business objectives and gaps.

You can do this by asking yourself the following questions:

- “What do I need to automate?”

- “What is my monthly CRM budget?”

- “What do I need to track better?”

- “What do I want my CRM to accomplish?”

- “What kind of support will I need?”

Understanding your CRM needs makes implementation simple. For example, if you find client communication to be a bottleneck, you can look for a CRM with email syncing and easy-to-use text functionality.

Here are 7 essential features for financial advisors to look for.

Email Automation

Email automation with CRM lets you create and schedule emails to go out at certain times to a specific audience.

You can use email automation for:

- Welcome emails for new client sign-ups

- Event invitations and reminders (in-person finance workshops, webinars, etc.)

- Appointment reminders

- Lead nurturing

Find yourself using email for the same thing over and over?

This is where you can automate emails using templates and sequences.

And since you’re using a CRM which has your customer data, you can use that data to make your automated emails more personalized and relevant.

Which will help you get more clients — and help you provide a better experience to your current clients.

Contact Management

Your contact management system stores valuable information from leads, clients, vendors, company partners, or anyone else you contact.

It’s a go-to hub for the names, emails, phone numbers, and notes of people important to your service.

With a CRM likeVipeCloud, contact management goes a step further with contact journeys.

Here you can get a birdseye view of how each contact has interacted with your business.

This includes the emails they’ve viewed, replies, things they’ve submitted, and so on.

Your contact management helps give you context, especially if you’re managing lots of clients’ finances at once.

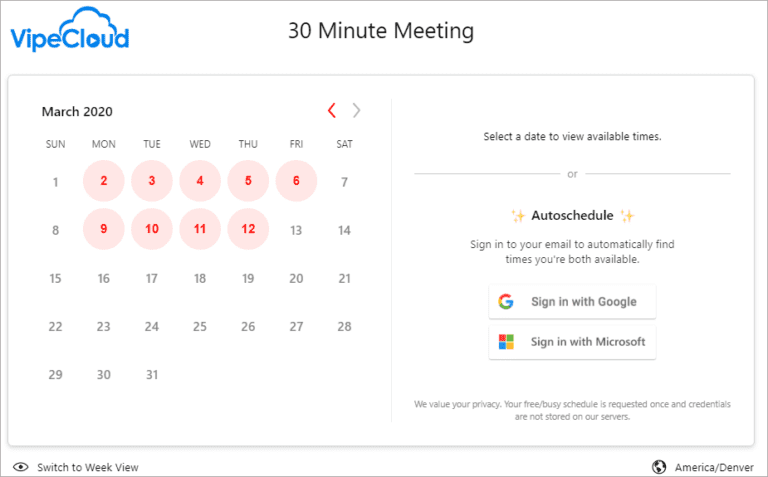

Schedulers

You can schedule client meetings, events, and more — directly in your CRM.

And the best part is that your updates to your scheduler will show up on your primary Google or Outlook calendar (thanks to syncing!).

You can also integrate your scheduler into your website or landing page, so it’s easy for potential clients to book a time with you that works for them.

Ideal Integrations

All-in-one CRMs come with integrations that connect to your tech stack.

For example, VipeCloud lets you integrate Zoom, Zapier, and QuickBooks — some of the most popular software that businesses are using today.

These integrations save you the time of switching from tool to tool and entering the same data multiple times.

Data across your integrated software easily sync and work together.

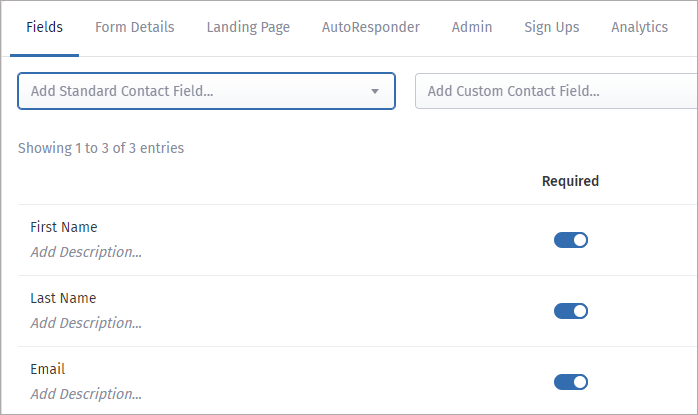

Forms

With CRM forms, you can create a custom intake process for different things, such as:

- Client onboarding

- Lead generation

- Service feedback

- Client financial updates

- Feedback forms

CRM forms are highly customizable, allowing you to add different types of fields — and even create your own.

With VipeCloud, you can do this simply by choosing a custom field, “datatype,” which is the type of data that’ll get accepted. (number, dropdown options, text, date, etc.) and then a name for your custom field.

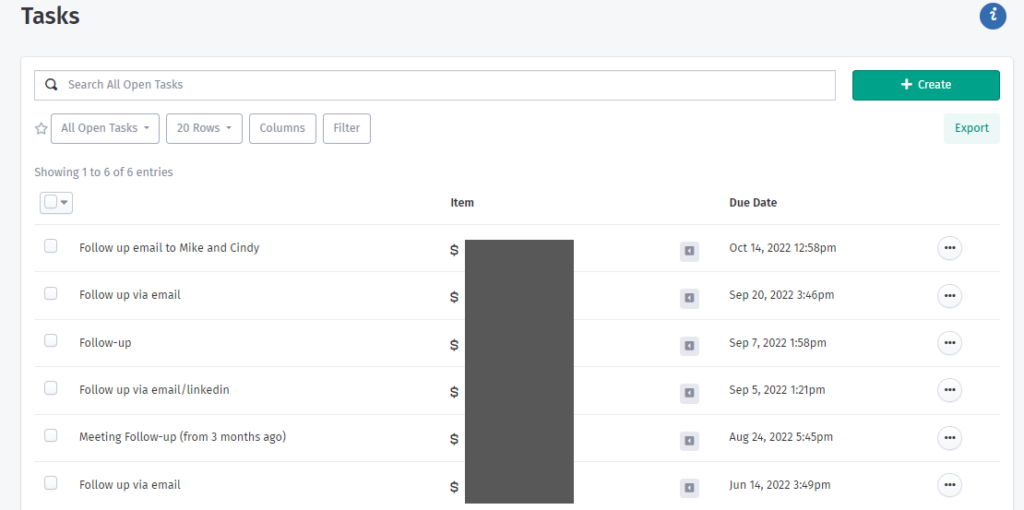

Task Management

Tasks keep you organized with your daily actions.

You can set tasks for yourself for follow-ups, completing investment summaries, tracking client investment performance, reviewing financial goals, and more.

You can also add your clients to your CRM and assign them tasks. This is a helpful use case if you need clients to submit something by a deadline.

Mobile Accessibility

A mobile-accessible CRM lets you gain the benefits of customer relationship management from your phone.

Instead of only working from your computer, you can work between meetings and on the go to be more efficient.

But remember that mobile CRMs can have drastically different capabilities than their desktop version.

So it’s critical to get clear on the features that matter most to you.

Here are the essential mobile CRM features for on-the-go access:

- Opportunities/pipelines

- Tasks

- Reports

- Templates

- Contacts

8 Ways To Use CRM For Wealth Management Services

1. CRM Schedulers For Meetings

You can leverage your scheduler to streamline how you set up meetings.

Simply configure your available hours each day of the week and let your clients book a time.

Meeting reminders can automatically get sent to everyone you’re meeting to reduce no-shows.

This greatly helps, especially for client meetings with a timetable, like tax filing deadlines.

2. Client Segmentation Based On Service Performed

As a financial service professional, your different skill sets may be helpful for different types of clients.

Understanding what each client type needs from you to improve their finances makes it easy to segment them.

Segmentation is when you group different clients based on their commonalities.

So, if you provide debt management, investment advice, and tax planning, there’s a chance you have clients that specifically want one service.

You can use the “tags” feature on your CRM to group clients based on the service you’re doing for them.

Another way of categorizing your clients is with pipelines.

You can create a service pipeline and put clients under the service category you’re performing.

Segmentation keeps you organized and makes it easy to send messages in bulk (email and text) to your clients.

3. Video Email For Client Updates

Findings show that people are 13% more likely to remember details from video emails over text emails.

Sometimes, video email is one of the best ways to share updates with your clients.

Video helps you better convey information, especially if you’re going into minute details with a client.

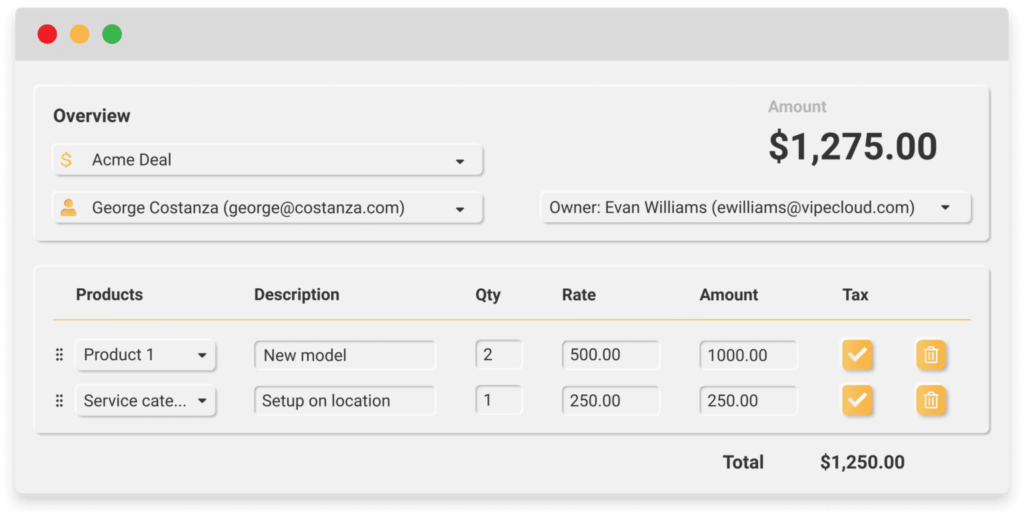

4. Integrating With QuickBooks For Revenue Tracking

You can create two-way syncing for finances by integrating Quickbooks with your CRM.

By doing so, the two systems can communicate, showing the activities occurring on each.

A helpful use case for this is with your estimates.

Estimates are pricing quotes you can send to people interested in working with you.

After sending, you can track if they were accepted or rejected it.

The best part is that the status of your estimate can be seen directly on your QuickBooks account.

5. Contact Scoring For New Leads

You can rank new leads based on their buying intent using contact scoring.

Contact scoring allows you to assign more points to hotter leads and lesser to colder ones.

You can score based on:

- Yearly income

- Occupation

- Financial goals

- Communiucativeness

- Timeline to get started

For contact scoring to be effective, get clear on the clients that fit your services the best.

Then, assign scores to those common attributes of the types of clients that you want to serve.

6. Task Management For Client Action-items

As mentioned earlier, you can organize your most to-dos with task management. This allows you to select a day and time to get reminded of the task.

Once completed, you can check it off and repeat the cycle.

Task management comes in handy, especially during busy timeframes like tax season and the end of the year.

7. Document Storage For Important Client Files

You can store important documents that belong to you or your clients inside your CRM.

Many cloud-based CRMs today come with modern security features, so you can securely centralize customer data.

You can keep document storage simple this way.

Which means no more guessing which file storage software your document is in.

8. Two-way Email Sync

CRM can sync with your email.

Wealth managers and financial advisors can track their emails from their CRM.

You can reply to clients and partners directly through your CRM like your typical email inbox.

Except, you can track opens and replies — and even auto-create contacts based on emails you send or receive to people.

The Best 5 CRMs For The Financial Services Industry

1. VipeCloud

VipeCloud is a CRM built for small and medium-sized businesses.

Financial service professionals can find easy-to-use tools and top-tier support for their needs.

It comes with tools you need every day, like pipelines, reports, schedulers, email, and integrations.

Users have applauded VipeCloud’s customer support and ability to consistently update the CRM with new features without heavily affecting pricing.

When first signing up for VipeCloud, you can get a 15-day free trial to see if it fits your needs.

Features

- Pipelines

- Reports

- Social media posts

- Contact management

- Tasks

- Estimates

- Scheduler

- Segmentation

- SMS

- Integrations

- Forms

Pricing

VipeCloud offers 4 affordable pricing tiers based on your needs.

Here’s how the pricing measures up when billed annually:

- Plus – $20 (or $25 monthly)

- Pro – $40 (or $50 per user monthly)

- Enterprise $60 (or $75 per user monthly)

- Custom – Contact for a quote

Here’s what each tier consists of:

Plus:

- Feature-rich CRM, one pipeline

- 2K contacts

- 10K monthly emails

- Email marketing

- Video email

- Texting

- Stories

- Social sharing

- Sign up forms

- 1 user

Pro:

- Everything in Plus, along with:

- 10K contacts per user

- 30K monthly emails per user

- Sales & marketing automation

- Custom fields

- Account management

- Sales estimates & QuickBooks integration

- Inbox sync

- 1 scheduler

- 1 team

- Phone support

- Up to 10 users

Enterprise:

- Everything in Pro, along with:

- 60K contacts per user

- 60K monthly emails per user

- One-email-per-minute mass email processing

- Multiple schedulers

- Website tracker

- Contact scoring

- 10K email verifications per month

- Multiple pipelines

- Multiple teams

- Unlimited users

Custom:

- Everything in Enterprise, along with:

- Custom contact count

- Custom email sending quantity

- Custom email verifications quantity

- Dedicated SMTP delivery account

- Dedicated IP addresses and DNS support

- Custom implementation and training

Reviews

Here are VipeCloud reviews from Capterra:

- “Easy to use! Great customer support! They went out of the way to make sure you are knowledgeable of how to use the system” – Julie B.

- “I came from having used a few competitors – so, i really can’t say that I have any real cons for VipeCloud – I like it better than anything else I have used.” – Steve W.

- “What separates a good company from a great company are the people and the product. This company has Both. Response time is instant, modifications and additions to the features happen like magic, most importantly they LISTEN and ask questions until they fully understand the needs of their client before they create a solution or demonstrate how to use the existing VipeCloud features to accomplish the required tasks. – Philip W.

2. Maximizer CRM

Maximizer CRM offers versatility to meet the different needs of financial professionals.

It comes with features like pipelines, document storage, marketing automation, estimates, and more.

From a pricing standpoint, Maximizer is best suited for financial teams (rather than solopreneurs) since it requires at least 3 users to start.

This CRM is known for its easy relationship tracking and high customizability. You can tailor it to your needs, especially with its vast integrations.

Features

- Alerts/Notifications

- Customer Database

- Client Management

- Document Management

- Pipeline Management

- Calendar

- Estimates

- Segmentation

- Marketing Automation

- Territory Management

- Activity Dashboard

- Collaboration Tools

- Relationship Tracking

- Team Assignments

Pricing

- $55 per user per month (3 users minimum)

- $75 per user per month (5 users minimum)

Reviews

Here are Maximizer CRM reviews from Capterra:

- “I have used Maximizer since the early 2000s. It is my MAIN source of CRM. I have many pre-edited documents that automatically get sent and merged with my contacts. I love this software and the amount of time and energy it’s saved me over the years.” – Todd I.

- Maximizer has everything I require to easily organize my client relationships without being cluttered with features I don’t need. It is simple, intuitive, and easy to use from the beginning, and the training modules are great.” – Verified User.

- “Having better integrations with other software would make our lives a lot easier. As well as having better duplicate checking for entries would eliminate a lot of work hours used to maintain a clean database.” – Megan D.

3. Wealthbox

Wealthbox offers niche-specific financial tools to help you track client information, appointment scheduling, and tasks.

The mobile app makes it easy to get more done since it has many features from its desktop version. Although financial advisors can be confident in Wealthbox’s ease of use, some have mentioned it is difficult to reach support when needed.

This CRM offers a user-friendly interface that’s inviting for people new to CRM. Pricing is on par with most small business CRMs.

Features

- Alerts/Notifications

- Contact Management

- Customer Database

- Client Management

- Document Management

- Lead Management

- Pipeline Management

- Activity Dashboard

- Collaboration Tools

Pricing

- Basic – $45 per user, per month

- Pro – $59 per user, per month

- Premier – $79 per user, per month

- Enterprise – Contact for pricing

Reviews

Here are Wealthbox reviews from Capterra:

- “Mailmerge fields are limited, as are integrations with the other platforms we use. I am not a fan of the support being only through a help request and not having a number to call to speak with someone. Many of the “upgrades” they make are only partially done that then need updates and fixes to improve and complete the intended use.” – Sarah W.

- “We love the software’s flexibility to create reports on most/all data points and ease of use. We are able to get new users up and running in no time. The information is displayed in an easy-to-read format. The mobile app was a lifesaver during the pandemic while employees were working from home as well as for our employees that are traveling and on the road.” – Anthony C.

- “This was the easiest and fastest setup of any CRM I used in the past. It matched my needs as I wanted something that I could tailor to meet my needs in a database. It is very easy to make changes to the CRM to add fields. I didn’t need to pay a consultant to change the face, fields, or integrate with other vendors. Note-taking is very simple, and I really liked the layout.” – Patrick C.

4. Redtail CRM

Redtail CRM simplifies client tracking by providing communication history, financial information, and more.

The usual CRM features include pipelines, calendars, tasks, and integrations.

Some users have mentioned Redtail lacks a modern feel with more capabilities. This CRM best suits financial advisors who want just a few tools.

Redtail comes with a mobile app.

Also, itsd pricing is straightforward.

Features

- Tasks

- Integrations

- Reporting

- Calendar

- Notes

- Mobile app

- Seminars

- Opportunities

Pricing

- $99.00 per month, per database

Reviews

Here are Redtail CRM reviews from Capterra:

- “Redtail is a good software and has a lot of functionality for contact management (assets, liabilities, notes, etc.) I do like that Redtail is more encompassing than many other CRMs (ex outlook) that can track way more customizable information.” – Chris D.

- “Low price point for a CRM that is built from the ground up to support Financial Advisers. SEC-compliant document management and email make this easy to archive and track client documents and communications in the secure cloud. Good integration with CopyTalk.” – Verified Reviewer

- “Content management and alerts and notification services of Redtail CRM is the one which they need to work on as for our perspective they are not up to the mark.” – Aman S.

5. Salesforce Essentials

Salesforce Essentials is a CRM for small businesses with a strong foundation in sales assets. You can access pipelines, estimates, file storage, and more at an affordable price (compared to its other CRMs).

Users have mentioned Salesforce’s steep learning curve, partly because of its UI.

Salesforce offers helpful customer support and can be compatible with small or large finance teams. All the tools together help streamline efficiency.

Features

- Case management

- Pipelines

- Estimates

- Automation

- Reporting

- Territory and quota management

- Contact management

- File storage

- Lead capture pages

Pricing

- It starts at $25 per month per user billed annually.

Reviews

Here are Salesforce reviews from Capterra:

- “Salesforce can be overwhelming when first starting to use it. There is a lot of information everywhere, and the pages feel very “busy” when you aren’t sure where to find something. The more you use Salesforce, the easier this gets, but for new users, there can be a learning period” – Kelly D.

- “Salesforce Essentials is more affordable than standard Salesforce and still has what I need in a CRM. I get work done faster, sell faster, and make our customer experience amazing. I set up a customized self-service portal and set particular concerns or questions to be sent to a specific person. This means that if, for example, a customer asks if a garment can be altered, they’re directed to our seamstress instead of directed to me and then transferred to our seamstress. Salesforce essentials records and tracks my calls and emails, meaning I no longer have to. I have gained more information about leads, where they come from, and why they choose us.” – Kaitlyn V.

- “There is definitely a big learning curve when it comes to using Salesforce. It’s obviously a massive piece of software that can be used for a huge array of purposes, so knowing how to navigate and find what you’re looking for isn’t always the easiest.” – Tyler S.

3 Best Approaches For Choosing A CRM

1. Attend Demos With Vendor Experts

Scheduling demos for CRMs you see potential in makes it easy to learn more and ask questions. The collective information you gather from experts can steer you in the right direction.

(Those interested in learning more about trying VipeCloud can request a demo to walk through the CRM.)

2. Focus On An Easy-to-use Solution

As you gather information on different CRMs and read reviews, ease of use should be a top priority.

With an easy-to-use CRM, you can start your workflows and meet client management needs faster. It also makes it easy to get more out of the core features you need for the day-to-day.

3. Go For Versatility

All-in-one CRMs give you a suite of tools you can leverage.

Even if you don’t need some of the tools right now, they’ll be available when needed and often at the same price point.

Versatile CRMs also open you to more efficient ways of doing workflows. For example, if you usually do email marketing, you can add your CRM’s SMS functionality to your follow-up process.

Scale Your Financial Services With VipeCloud

VipeCloud is a CRM built for small businesses and made to scale with you.

Financial advisors and wealth managers can gain value in its pipelines, mobile capabilities, QuickBooks integration, and more.

Request a demo today to get a strong scope of what VipeCloud can do. Our CRM experts will be happy to walk you through the CRM.

Or, if you prefer to get started now, VipeCloud comes with a 15-day free trial when you sign up.

Leave a Reply