In this definitive guide, you’ll be shown the ropes when it comes to using mortgage CRM the right way to expand your clientele year over year.

As a lender, your role in home buying is valuable for so many of your customers.

By dialing in and organizing your business, you can market to and build relationships with your target demographic of homeowners, borrowers, and even referral partners.

One of your best assets for this is a Mortgage CRM that helps win customers and lets you track business performance!

You’ll learn in this post:

- What Is A Mortgage CRM?

- Why Is Adopting A Mortgage CRM Solution Crucial?

- What Are Some Mortgage CRM Use-cases For Winning Clients?

- How to Find the Right Mortgage CRM Software

- When is the Time to Purchase a Mortgage CRM Software?

- What Is The Top Mortgage CRM And Why?

VipeCloud is the only Automation tool your small business needs to

be the hero to your customers.

With Email, Texting, Social, Suites, Chat, Stories, Video Email & Sign Up Forms fully built-in, we provide you with the perfect platform to grow your business.

15 Day Free Trial – Get started risk free. No CC needed.

What Is A Mortgage CRM?

CRM stands for customer relationship management.

When deployed in the mortgage industry, it tracks business progress, serves borrowers, and markets to new customers on multiple platforms.

Mortgage CRMs allow you to take advantage of automation which reduces the monotony of sales and marketing tasks:

This includes workflows like email marketing automation to send content to your contact list and social sharing to reach and automate content for your social media audiences.

Mortgage brokerages and loan officers often face the issue of not having enough clients or leads.

And those that do have a steady chain of referrals, aren’t managing and following up with them efficiently.

The average loan officer (and especially mortgage brokerages as a whole) has 101 other things to manage.

With things like qualifying customers for loans, contacting realtor partners, and tracking sales improvements, it’s simply too much to just “wing it.”

And since the industry is only getting more competitive, you need the competitive advantage of CRM more than ever in today’s market.

Why Is Adopting A Mortgage CRM Solution Crucial?

Here are a few reasons why using a mortgage CRM is critical.

Boosts Pipeline Management

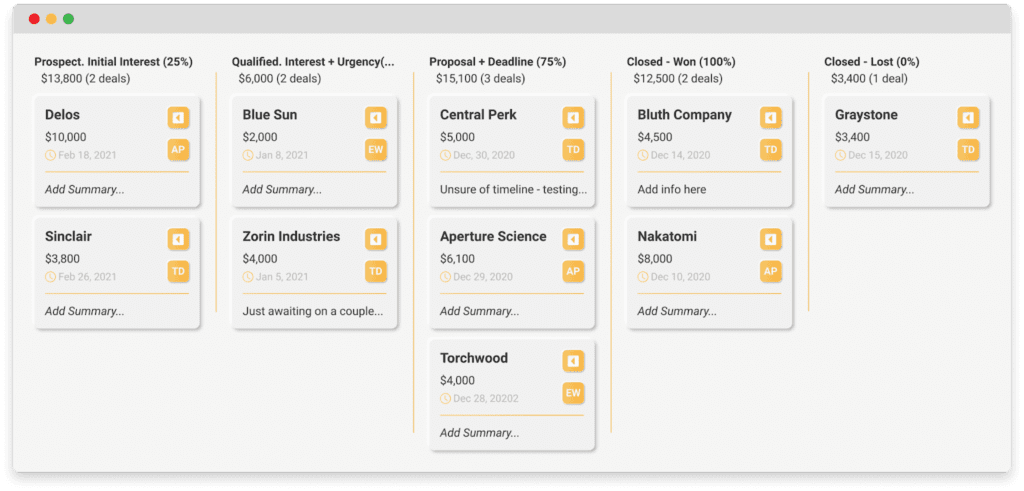

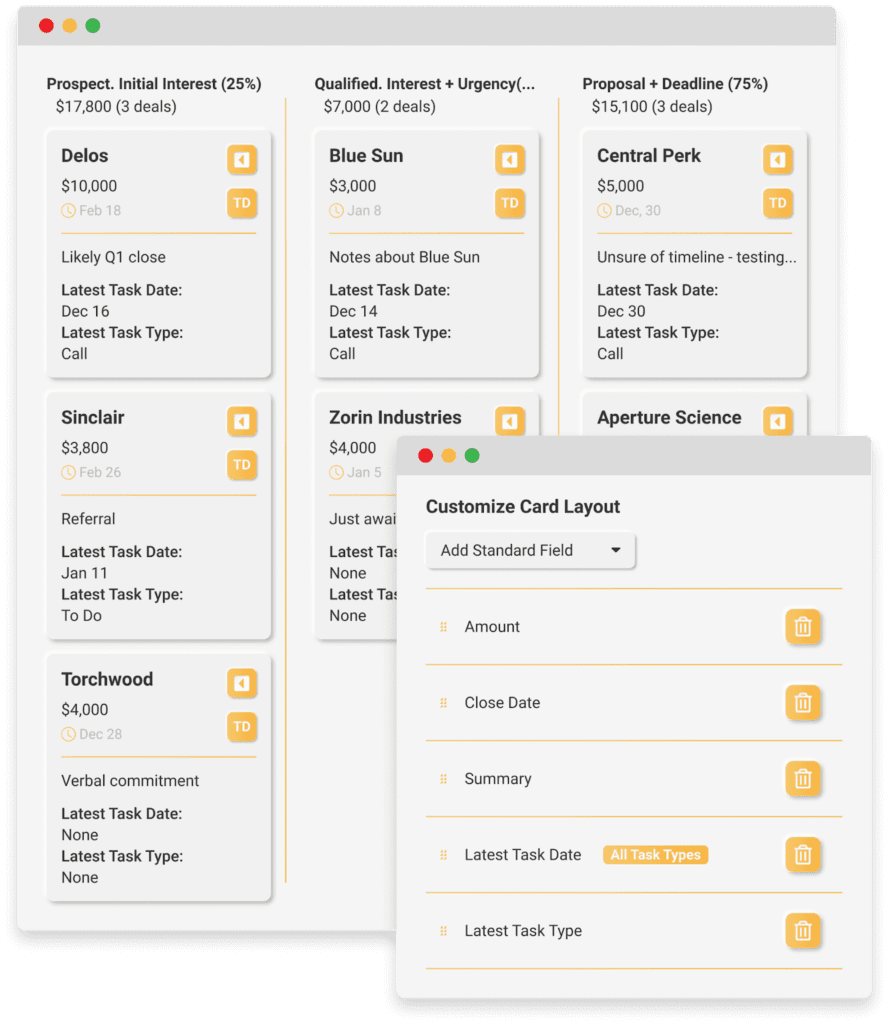

With mortgage CRM you can customize and create multiple pipelines based on how your sales cycle looks.

By having your deals all in one place, you can follow up with borrowers based on what they need and prioritize the accounts that have the most value for your business (and to whom you can give the most value.)

For example, a customizable CRM like VipeCloud allows you to display the final task types completed for your deals.

What’s great about this feature is you can track what activities your team performed for each deal.

You can also name your pipeline stages to reflect the customer journey your borrower goes through as they’re getting a loan.

With better pipeline management, it’s easier to:

- See where deals are falling and why

- Make better sales adjustments

- Re-engage past prospects with better timing

- Serve customers with a more personalized experience

Improves Your Mortgage Marketing

A robust mortgage CRM should be versatile, meaning it should come with features that help you maximize marketing, sales, and the customer experience.

From a marketing standpoint, getting in front of your audience has never been easier.

CRM email marketing, text message marketing, and social sharing are great tools to reach and nurture borrowers on multiple platforms.

Even sign-up forms can be the perfect lead generation tool to collect prospect data.

These tools can be scheduled, automated and A/B tested for optimal results.

So with marketing streamlined, you’re in a better position to keep your pipeline full.

In CRM, you’ll also find plenty of marketing analytics, which is valuable data that helps gauge the effectiveness of your campaigns.

Lastly, a massive plus-side of mortgage CRM marketing is how automation saves you time.

About 51% of companies are leveraging marketing automation right now.

Creating your different campaigns automates the customer acquisition process, which is extremely important if you’re an independent loan officer and not operating with a large brokerage, or working with a bank.

You can focus on other high ROI tasks like evaluating loan applications and borrower eligibility by using automation.

Helps Better Manage Everyone In The Business Ecosystem

Mortgage CRM houses the data about your customers and key company partners.

Many loan officers and mortgage brokerages work in tandem with real estate professionals and can consistently gain referral business from them.

You can store the information on your referral partners, helping you stay in contact with them on important days.

So the main idea here?

Think of your CRM database as something that stores your professional network as a whole. From there, you can create workflows that engage your network as needed and segment your contacts based on shared interests or their value to your company.

What Are Some Mortgage CRM Use-cases For Winning Clients?

1. Email Marketing

In 2020, marketers were surveyed, and 78% said email is vital to overall company success, which was more than the 71% just a year prior.

Email marketing has stood the test of time, and it’s clear that it isn’t going anywhere.

So by adopting a mortgage CRM, email marketing is one the best mediums to reach and nurture your list of customers.

Here are some more specific use-cases:

- You can create email sequences for potential borrowers that join your list. This can be a “welcome email” sequence where you build it one time, and it’ll send out for each new contact.

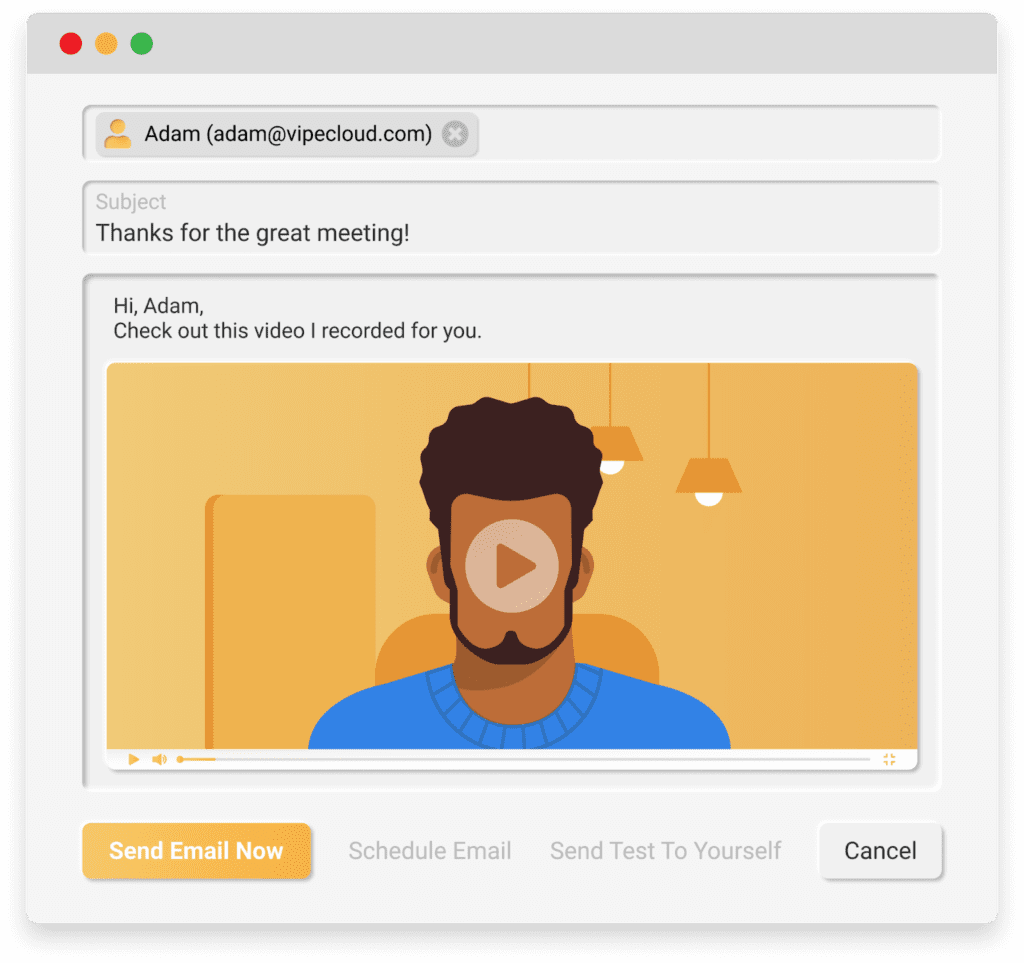

- Send video emails that deliver value and speak about your value proposition

- Send automatic call or meeting reminder emails from your scheduler tool when a prospect schedules an appointment. This allows them to confirm the meeting and saves you time if a reschedule is needed.

- Weekly emails dedicated to specific customer segments. For example, tailored emails for millennials on your list and then tailored emails for gen-Xers.

2. Customer Segmentation

Relevancy is the future of marketing automation.

Today’s mortgage borrower consists mainly of gen x-ers, millennials, and baby boomers.

However, evidence shows that millennials are at the forefront when it comes to mortgage loan applications.

On top of that, these groups respond to different offers.

Why?

Because what they value and prefer differs.

So that means customer segmentation is crucial as a mortgage loan operator.

Here are a few tips you can use to segment your customers with a mortgage CRM

- Use sign-up forms that gather demographic or geographical information

- Segment leads based on the type of sign-up form that was filled (you can have different forms for different audiences and campaigns)

- Segment customers based on the type of mortgage loan they received

- Segment leads based on their position in your sales pipeline

- Segment based on behavior. This can be done by lead scoring, calls to action clicks, email opens, etc.

By segmenting, you’re creating a more valuable buyer journey since your touchpoints are tailored to the customer’s needs.

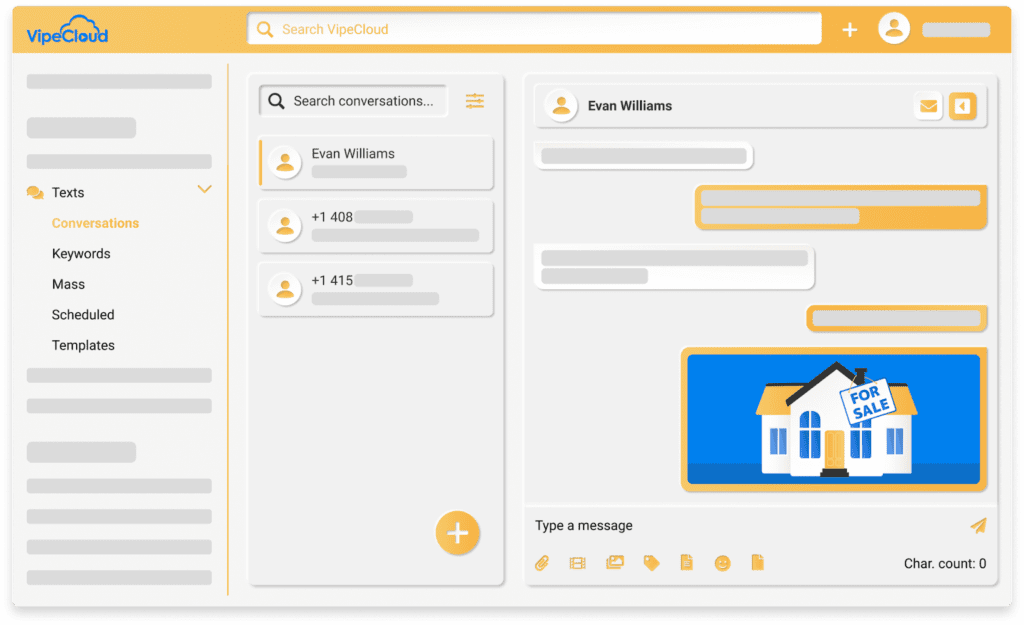

3. Text Message Marketing

Text message marketing allows you to add another means of getting in touch with contacts.

You can create automated texts for booked appointment confirmations or reminders for loan estimates that were sent out.

You can set key text message sequences based on customer behavior or their current position in your sales pipeline.

As you may already know, it’s essential to keep in mind that borrowers are looking for the best deals possible, so it’s natural for them to shop around.

You can engage them on their phones by implementing text message marketing (something your competitors are likely skipping out on).

4. Social Media Content Marketing

I’m sure you’ve heard the adage, “content is king.”

It’s a famous phrase because it’s true!

Content is the pillar of inbound lead generation.

When we look at industries with many moving parts and details to them, educating your customer is very important.

Although the mortgage industry tends to be B2C, borrowers treat your interactions like a B2B deal.

They need lots of information, and sometimes, lacking information prevents them from even speaking to a professional because they simply “do not know where to start.”

So by creating educational loan content on social media, you can teach them essential best practices when applying for mortgage loans.

(This goes a very long way in building trust.)

And as they receive educational content from your company, they’re more likely to begin their journey with you over competitors.

And again, this can be automated.

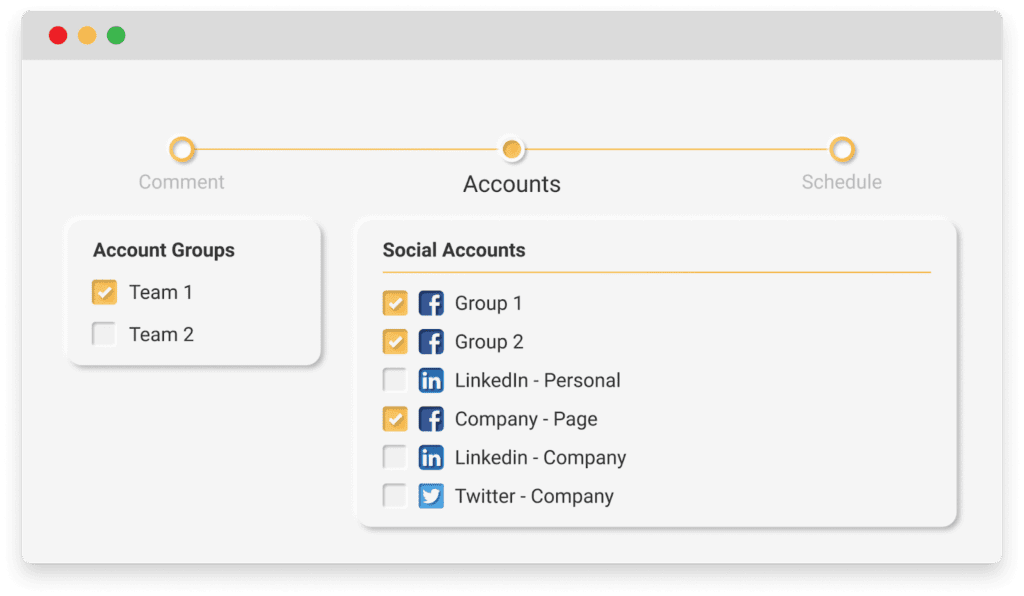

For instance, VipeCloud’s CRM has a feature called, social sharing, which allows you to schedule and automate content for your social media pages.

And it’s proven that millennials (again, the biggest group for mortgage loans) are spending roughly 3.8 hours on social media each day anyway.

Remember, this doesn’t just have to be millennials — it can be content for any group of people you’ve segmented.

Having your customer segments on your social network and posting consistent, educational content will facilitate a growing clientele base.

5. Sign-up forms

Sign-up forms are pages that collect data on leads and customers.

Companies typically use these to collect demographic data, but forms can also help you gauge customer sentiments through surveys too.

If you’re running paid ad campaigns for your loan company or using organic SEO to gain traffic, sign-up forms are a great way to convert visitors.

Lastly, when building your form pages, be sure to include important information that complies with mortgage loan regulations.

With all these use-cases mentioned above, let’s delve into the best mortgage CRM for your company.

How To Find The Right Mortgage CRM Software

To find the best mortgage CRM software, first, you have to understand the goal of implementing one in your mortgage business.

Generally, a good mortgage CRM software should satisfy the following requirements:

- Enable you to close more loans faster and easier

- Help you with loan pipeline management

- Significantly increase your pipeline

- Help you create loan reports seamlessly

- Help loan officers manage leads and contacts

- Obtain positive customer relationships

What’s more, the best CRM software should provide a wide variety of pricing plans and features. It should take into account small businesses’ needs as well as the industry’s largest mortgage lenders.

When Is The Time To Purchase a Mortgage CRM Software?

The ideal time to start looking for and using mortgage CRM software is when you decide to enter the mortgage business.

Your LOS ensures that your calculations are correct. When correctly configured, your mortgage CRM software will update your transaction record, keeping you out of trouble with your state’s banking and finance authority.

In addition, good mortgage CRM software will help you with loan pipeline management to safely store customer data required for compliance.

What Is The Top Mortgage CRM And Why?

An outstanding mortgage CRM needs customizability and critical features that help you in the marketing, sales, and customer service front.

If you’re looking for versatility, ease of use, and cost-effective CRM adoption, then VipeCloud is proven to help mortgage brokers.

VipeCloud’s Sales & Marketing Suite comes with all the above-mentioned marketing tools, a customizable pipeline, third-party integrations like Quickbooks, and so much more.

Simply put, it’s a CRM that grows as your business grows.

With its simple learning curve, you’ll have a tailor-made mortgage CRM ready to win your business more deals.

Want to see it for yourself?

Try VipeCloud today for 15-days FREE!

If you have questions, feel free to request a demo, and our team will answer them while walking you through how it works.

Leave a Comment