This article will help CPAs, accountants, firms, and tax professionals learn to use CRM to build more valuable client relationships.

CRM accounting software helps financial professionals attract new business while strengthening relations with current clients.

Today we’re going to dive into the value and use-cases of CRM for accountants and CPAs.

You’ll also learn valuable tips from our interview with Maryland-based CPA Scott Melcher on ways to build better client relationships (because that’s the foundation of growing your business).

Table of contents:

- What Is CRM For Accounting?

- Do Accountants Need A CRM?

- Why Should Accountants And CPAs Focus On CRM?

- 3 Tips For CPAs To Have Better Client Relationships From Scott Melcher

- How Do Accounting Firms Use CRM?

- What Are CRM Use-cases For Accountants & CPAs?: 9 Things To Look For

- What Is The Best CRM For CPAs, Tax Professionals & Accounting Firms?

VipeCloud is the only Automation tool your small business needs to

be the hero to your customers.

With Email, Texting, Social, Suites, Chat, Stories, Video Email & Sign Up Forms fully built-in, we provide you with the perfect platform to grow your business.

15 Day Free Trial – Get started risk free. No CC needed.

What Is CRM For Accounting?

CRM for accounting gives financial professionals a way to:

- Market services

- Better manage leads

- Sell better by tracking numbers with CRM analytics

- Automate client communication such as reminders (and other workflows)

- Set & automate tasks

- Schedule meetings

- Streamline estimates

- Access integrations

These features give financial professionals more leverage on their time, which is especially important for solopreneurs.

But maybe your operations have been successful up to this point.

And you’re still thinking, “Is CRM even necessary?”

Let’s dive into why CPAs, tax professionals, and accounting firms should invest in CRM.

Do Financial Professionals Need A CRM?

Financial professionals should use CRM because it organizes internal operations better.

CRM can boost marketing capabilities while reducing business expenses. Historically, accountants have relied on spreadsheets, memory, scattered software, and miscellaneous files for their business operations.

Everything was simply disconnected.

Which led to client information and service delivery getting slowed down.

CRM looks to unify customer data and your different software to make service delivery smoother and your (or your team’s) job easier.

During adoption, accountants and CPAs should focus on versatile CRMs that serve email, text messaging, schedulers, forms, pipelines, and estimates.

Why?

It’s because CRM versatility allows you to pick and choose the features that fit your business the best.

It’s better not to need all the features than to need more than what’s there.

92% of businesses mentioned that CRM played an essential role in reaching income goals.

Why Should Accountants And CPAs Focus On CRM?

To Facilitate Growth

CRM gives financial professionals the infrastructure to grow their business.

Systemizing revenue tracking, automation workflows, and communications allow you to take on more business without affecting service delivery.

In other words, scalability potential dramatically increases. As a result, you can get more done with your time than before.

Simplifying Operations

CRM simplifies your operations in the following ways:

- Marketing becomes more trackable (than only relying on referrals)

- Sales deals are straightforward thanks to pipelines and analytics

- Customer journeys and conversations are recorded for future reference (contact database, email, SMS, etc.)

- The latest tasks accomplished are visible, helping with productivity and service effectiveness

- Your most crucial tools are consolidated into one system

Improving The Customer Experience

Thanks to CRM, CPAs can house detailed information, which helps with personalized campaigns for your prospects and customers.

And a use-case is with text message automation.

Have you ever texted customers about paperwork or tax form due dates?

With text message automation, reminders can be scheduled to run on a specific date and time with personalized fields.

Automation lends itself to a good customer experience.

And a good customer experience is the foundation for better customer relationships.

Which is what Maryland-based CPA Scott Melcher says is paramount.

A lot of Melcher’s business growth has come from referrals which was a result of building good relations with clients.

3 Tips For CPAs To Have Better Client Relationships From Scott Melcher CPA

We were fortunate enough to speak with Scott Melcher about how CPAs and financial professionals can build stronger relationships that lead to more referrals.

The following 3 tips are some of the biggest factors to his success as a 5-star CPA.

1. Be Available & Flexible

No matter the niche you serve, there’s a chance your clients are busy people.

This means there’s a high likelihood that they value someone that can adapt to their schedule.

CPAs and accountants can be more available by answering phone calls, emails, and text messages in a timely manner.

Being available in this way shows flexibility and care to deliver clients an excellent service meant for busy business operators.

Being available to clients helps you:

- Stand out from competitors

- Build loyalty

- Open more opportunities for feedback that leads to business improvement

2. Being Transparent

Transparency builds trust in the eyes of your clients.

Without trust, a client relationship can’t be built

Building transparency can be done by:

- Having honest communication

- Being responsive

- Having pricing integrity

One way to have more pricing integrity is by having value-based pricing.

Accountants can build transparency by focusing on a value-based pricing model instead of charging monthly or always charging by the hour.

For instance, you can charge based on the specific service or the hours you’re spending on tax consulting to businesses.

Value-based pricing builds better relationships because customers see the direct ROI they’re getting from your services.

For clients, this beats paying the same monthly rate for months where they don’t need much tax or accounting help.

This will help you build trust with clients, something that’s crucial in the accounting industry.

3. Have Active Communication

Giving clients updates via emails, text messages, or in-person plays into active communication.

As an accountant who wants to build trust, staying in communication with clients is one key to building valuable and long-term client relationships.

Having important communication software such as good VOIP services is one way to improve client relations.

It shows that you’re on top of what the client needs, wants, or has to get done. You can further improve active communication by messaging clients in times when it’ll provide the most value.

For example, CPAs can do this by simply texting clients when their estimated taxes are due.

How Do Accounting Firms Use CRM?

Here are features accounting firms shouldn’t ignore in their CRM adoption process:

- Contact management – The ability to store thousands of contacts and organize them under different attributes, categories, and pipeline stages.

- Estimates – Sending price quotes to get agreed-upon pricing before invoicing clients.

- Internal workflow management – Using pipelines, task reminders, and CRM communication channels to accomplish workflows promptly.

- Lead management – Pipelines and contact scoring to organize leads based on their value to your firm.

- Tracking client inquiries – Client service pipelines and ticketing systems to organize client assistance.

- Schedulers for meetings – An organized way to schedule the next meetings without having to lead your CRM or connect an external calendar.

- Integrations with other software – Helps you scale by connecting with other important software that plays a valuable part in your accounting firm.

What Are CRM Use-cases For Accountants & CPAs?: 9 Things To Look For

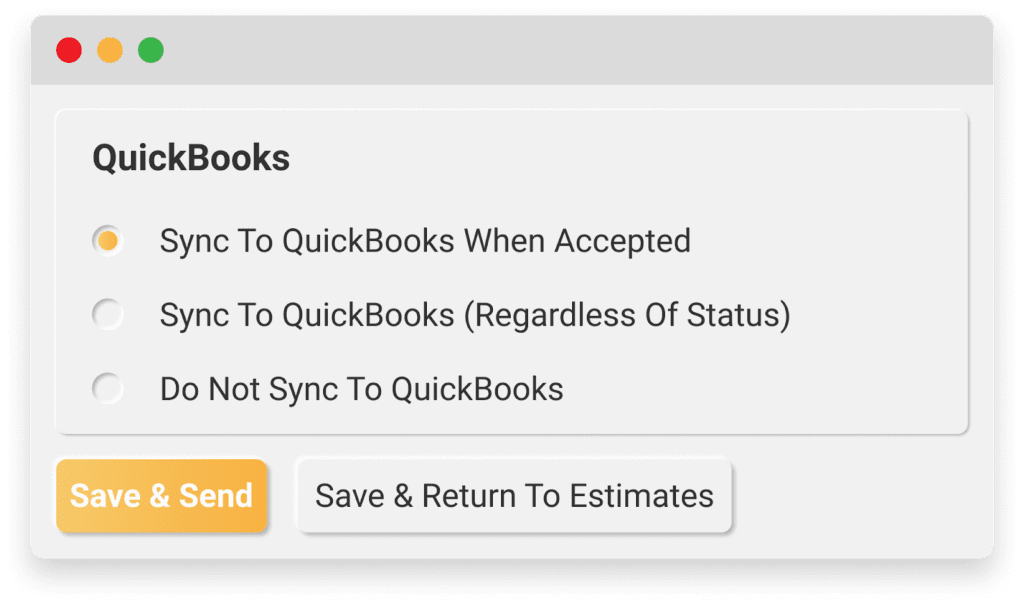

1. Integrating With QuickBooks

Every accountant knows what QuickBooks is.

CRM integration with QuickBooks allows both systems to communicate with one another.

(The information you enter in CRM or your accounting tool will sync into the opposite tool)

VipeCloud’s CRM can import Quickbooks data into your CRM, keeping it up-to-date (later, I’ll cover how it works well with Estimates).

2. SMS And Email Automation For Reminders

Text messages and email can be used to send clients reminders.

For instance, you can set a text message reminder to send 3 weeks before business taxes are due.

Another example could be requesting Google reviews via email and SMS.

At the end of your message, you can add your google review link for your happy customers.

And again, having the ability to amass lots of 5-star reviews goes back to building trusting and strong customer relationships.

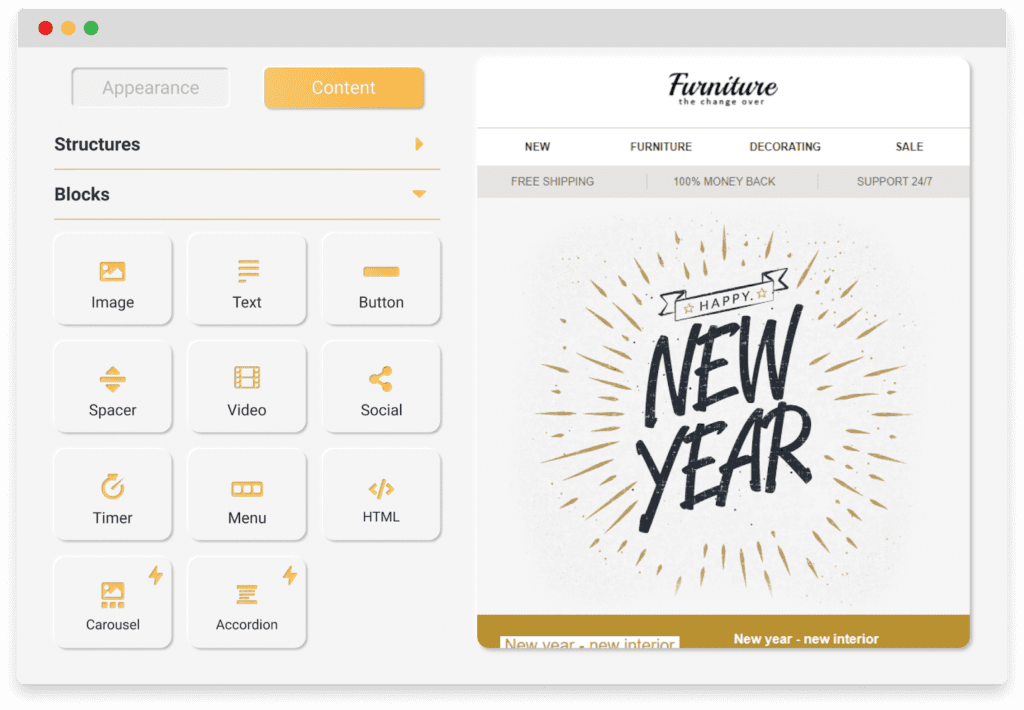

3. Email Newsletters

Email newsletters can keep clients up to date with the latest tax news.

However, make sure to not make your emails too long or send them too often, especially if the demographic you serve is full of busy business people.

Your emails should contain valuable information coupled with a call-to-action when it’s necessary.

This is how you get consistent opens and clicks.

Here are examples of valuable email newsletter topics:

- Industry financial news (segmented by client industry)

- Actionable tax-saving and accounting tips

- Emails that give an incentive in exchange for a referral

- Announcing an upcoming tax webinar for your clients

- Telling a relatable customer story (segmented by client industry)

- An email that answers common client questions

- Link to new blog posts centered around accounting

Fortunately, VipeCloud’s Marketing Suite offers a wide range of email templates to make these emails stand out and increase conversion rates.

4. Contact Segmentation

Segmentation organizes clients better, which can be done by using tags.

So, for instance, if you do accounting for healthcare and manufacturing companies, you can separate the clients based on their industry.

From there, you can have personalized messaging for each demographic.

In addition, you can save the messaging as templates, which can be used again in the future to save you time.

Segmentation can expand to service delivery pipelines too.

This is when you create a pipeline and put clients under organized categories.

You can create pipelines specifically for payroll tasks, general accounting, and tax season planning.

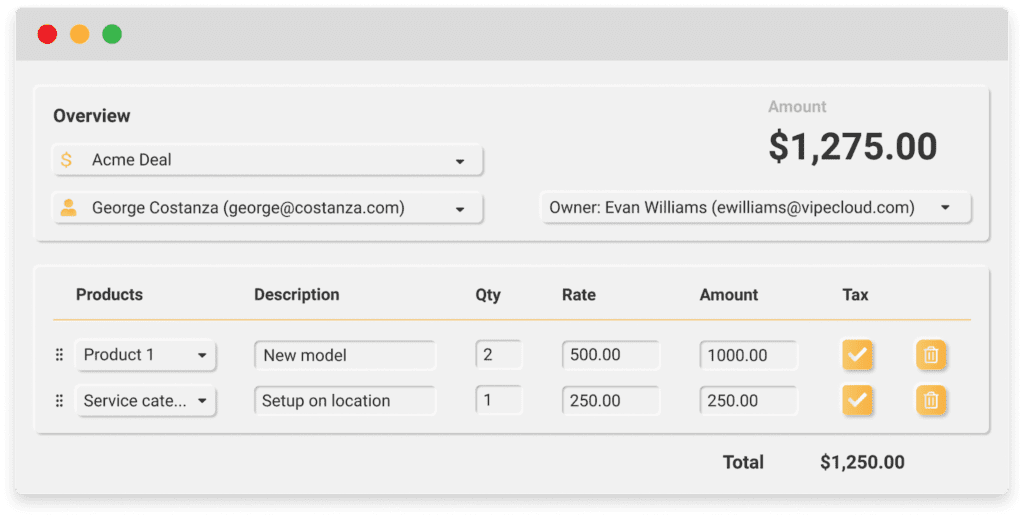

5. Estimates

Estimates provide clients with the price for doing business with you.

With VipeCloud, they can be created with the ability to add tax on top of your services, increasing its accuracy.

VipeCloud’s Estimates helps you get rid of the PDFs thanks to sending your estimates as a trackable link.

Your contacts can accept estimates via email when they receive them (an activity log is visible on the estimate to track each event).

Lastly, all of these activities are updated in QuickBooks seamlessly, reducing manual entry.

6. Scheduler

Scheduling makes setting up meetings simple, whether with clients or new leads.

You can share a link with your customers to book a time to meet with them.

This exceeds coordinating meetings over text and email.

If you happen to work with customers in different time zones, VipeCloud’s scheduler displays the local timezone for your recipient to ease any confusion.

You can:

- Sync this scheduler with calendars associated with your email

- Brand your scheduler with your logo

- Create multiple calendars for different purposes

- Add your scheduler to your email signature

- Add it to your website or chatbot to book visitors for a meeting

- Better nurture leads who didn’t schedule an appointment thanks to trackable links

7. Task Management

Task management and automated workflows help systemize your operation.

A use-case is reminding yourself or a team member to contact a client on a specific day or time.

Accounting firms can assign tasks to team members, and they’ll be notified of what needs to be accomplished along with a due date.

8. Click-to-Call

Click-to-Call is a functionality on VipeCloud’s mobile app.

This lets you call your clients and prospects and later fill in notes and set new reminders from the call.

Going back to CRM consolidation, your client interactions can remain in VipeCloud, making it convenient when you’re working during the busy season.

9. Forms

Sign up forms can be created to collect data for:

- Lead generation on a landing page

- Feedback intake using surveys

- Registrations

VipeCloud’s form builder lets you customize your call to action, images, videos, backgrounds, and “thank you” messages to match your branding.

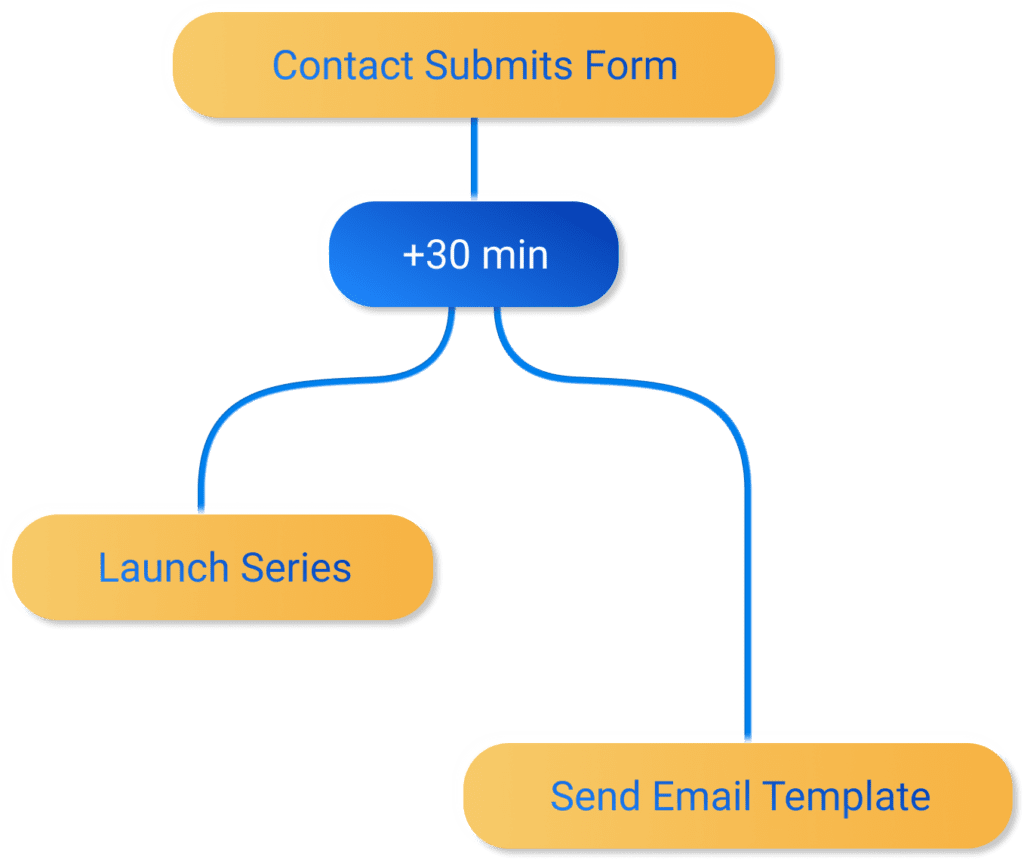

Once forms are submitted, you can also set drip sequences to get triggered.

For instance, if a lead in the nonprofit industry filled out a form, they can get a 4-email drip campaign that nurtures them to book a call on your scheduler.

The emails in this sequence can consist of actionable tax-saving tips for nonprofits, relatable customers stories, and incentives to book a call with you.

What Is The Best CRM For CPAs, Tax Professionals & Accounting Firms?

VipeCloud is the best CRM for CPAs, tax professionals, and accounting firms since it brings the versatility that helps build better relationships.

Remember that VipeCloud is your leverage point, but providing excellent service is what will truly scale your clientele.

VipeCloud’s Sales & Marketing Suite provides the following features:

- Email newsletters

- Text message marketing

- Social sharing

- Pipelines

- Lead scoring

- QuickBooks integration

- Reports

- Schedulers

- Task Management

If you’d like to see VipeCloud in action and learn how it can be customized for CPAs, request a free demo today.

If you’d like to take action and implement VipeCloud, you can do so starting with a 15-day free trial!

CRM For Accountants FAQ

When looking for CRM software for your accounting business, here are some important features to consider:

Contact Management: A good CRM for Accountants should offer robust contact management features, allowing you to keep track of all your client information in one place.

Document Management: Look for a CRM that has built-in document management features, allowing you to store and access important documents like tax returns, invoices, and financial statements.

Task Management: The ability to create and assign tasks to yourself or other team members is essential for managing workflow and ensuring deadlines are met.

Reporting and Analytics: A CRM with robust reporting and analytics features can help you gain insights into your practice, identify opportunities for improvement, and make data-driven decisions.

Integrations: Look for a CRM that integrates with other tools you already use, such as accounting software or project management tools. This can help streamline your workflow and reduce manual data entry.

Security: Since you’ll be storing sensitive client data in your CRM, make sure it has strong security features like two-factor authentication and encryption to protect against data breaches.

Integrating your accounting software with your CRM solution can simplify your invoicing and administrative tasks by automating them. This means that when a client settles their invoice, the integrated system can automatically match the payment details with the relevant record in your accounting CRM software.

CRM is important for financial services because it helps banks manage customers and understand their needs, leading to improved customer satisfaction and profitability. It also aids in compliance and regulatory requirements.

Leave a Comment